Long before the watch world discovered the virtues of virtual tools, record-breaking sales were actual spectacles of reverential rarities going under the hammer. Overseen by a handful of specialists, auction houses in the early ’90s mostly offered complicated pocket watches from Patek Philippe, Breguet and Vacheron Constantin. The Rolex mania hadn’t hit the world just yet, and the vintage market was predominantly fueled by the desire for 19th century enameled watches and automatons from the 1800s. Besides the rich, jet-setting Italians who had exceptional tastes and an unmatched appetite for rare collectibles, the market for vintage wristwatches in the late 1990s got a real boost with the introduction of Antiquorum’s themed auctions and brilliantly illustrated catalogs. Founded and run by the suave Osvaldo Patrizzi, Antiquorum’s unique sales would often unfold like a nerve wracking thriller, with billionaires pitching aggressively for unicorns and rare birds. One of Patrizzi’s most memorable shows was The Art of Patek Philippe, a mono-thematic auction that marked the brand’s 150th anniversary in 1989 with a specially curated selection of 301 watches that fetched USD 15 million. However, the watch that actually put Antiquorum and Patrizzi on the map was the unique Patek Philippe platinum ref. 1415 HU, which was sold for a record breaking CHF 6.6 million in 2002.

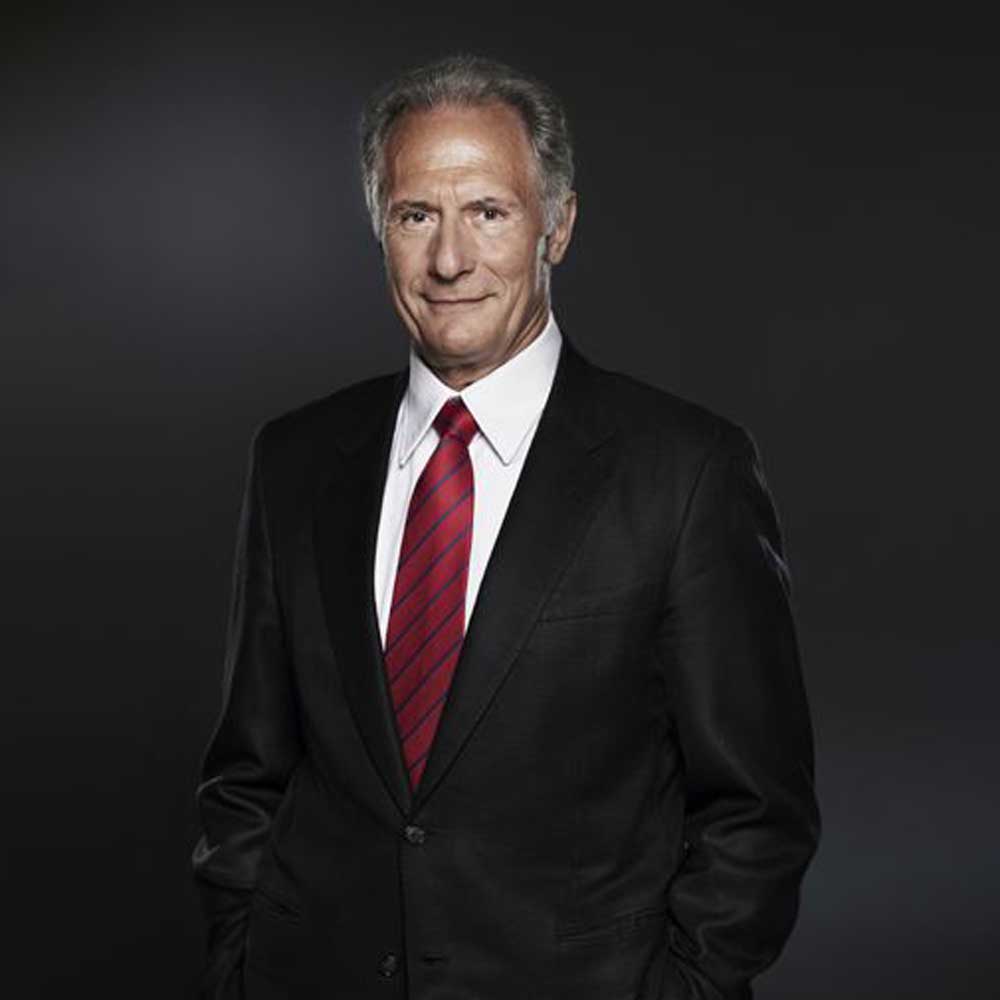

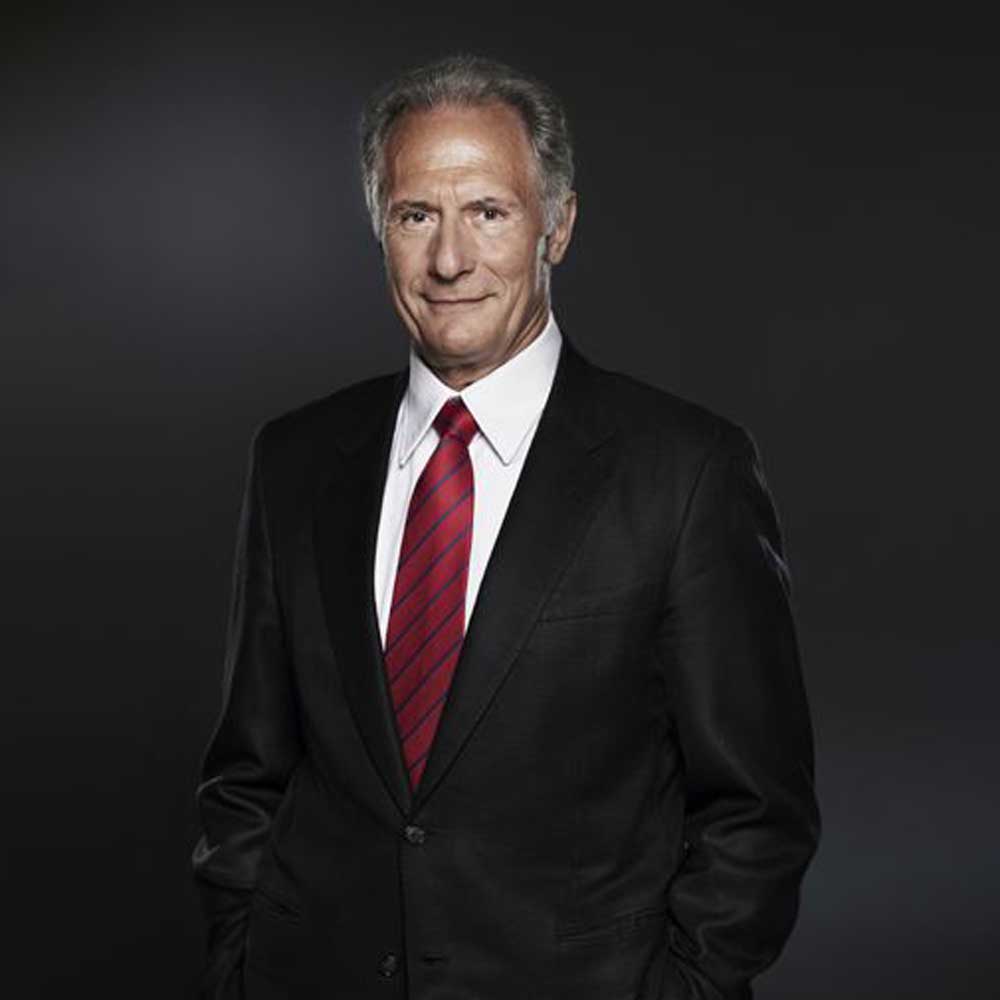

Osvaldo Patrizzi, founder and former chairman of the specialist watch auctioneer Antiquorum

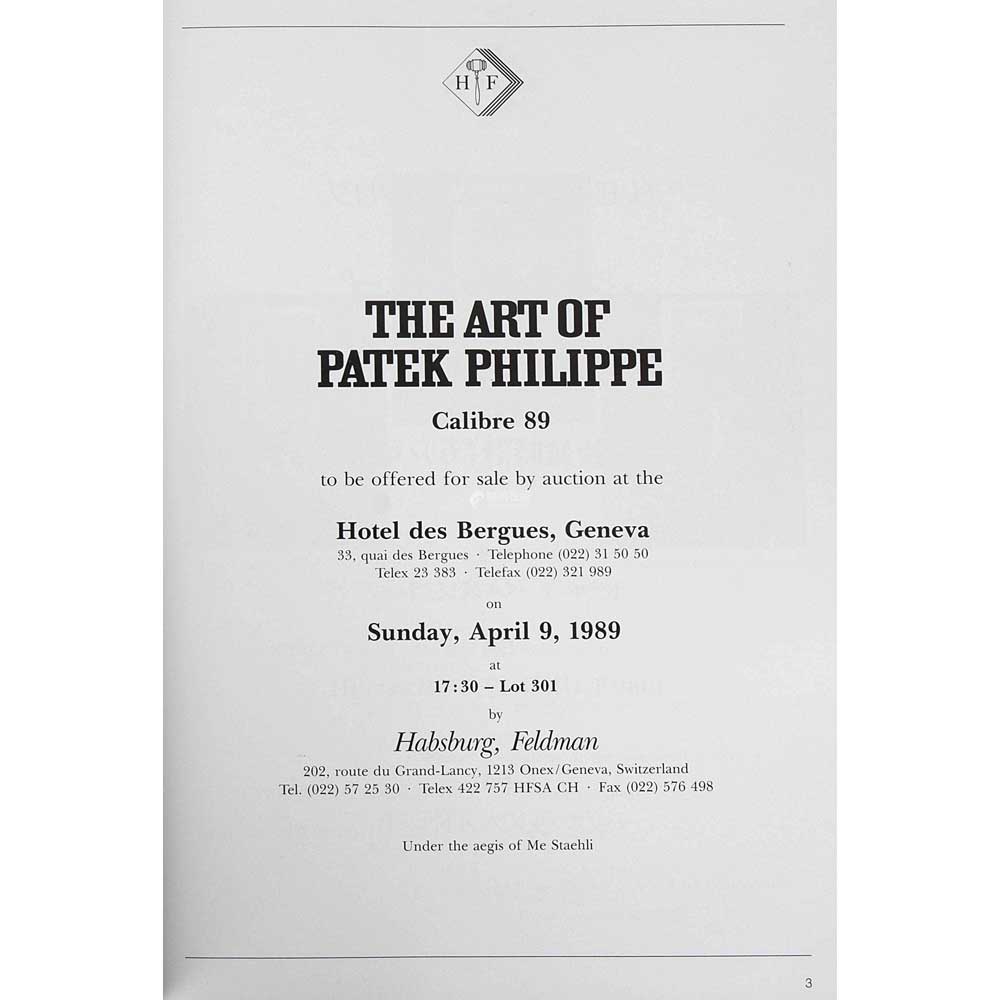

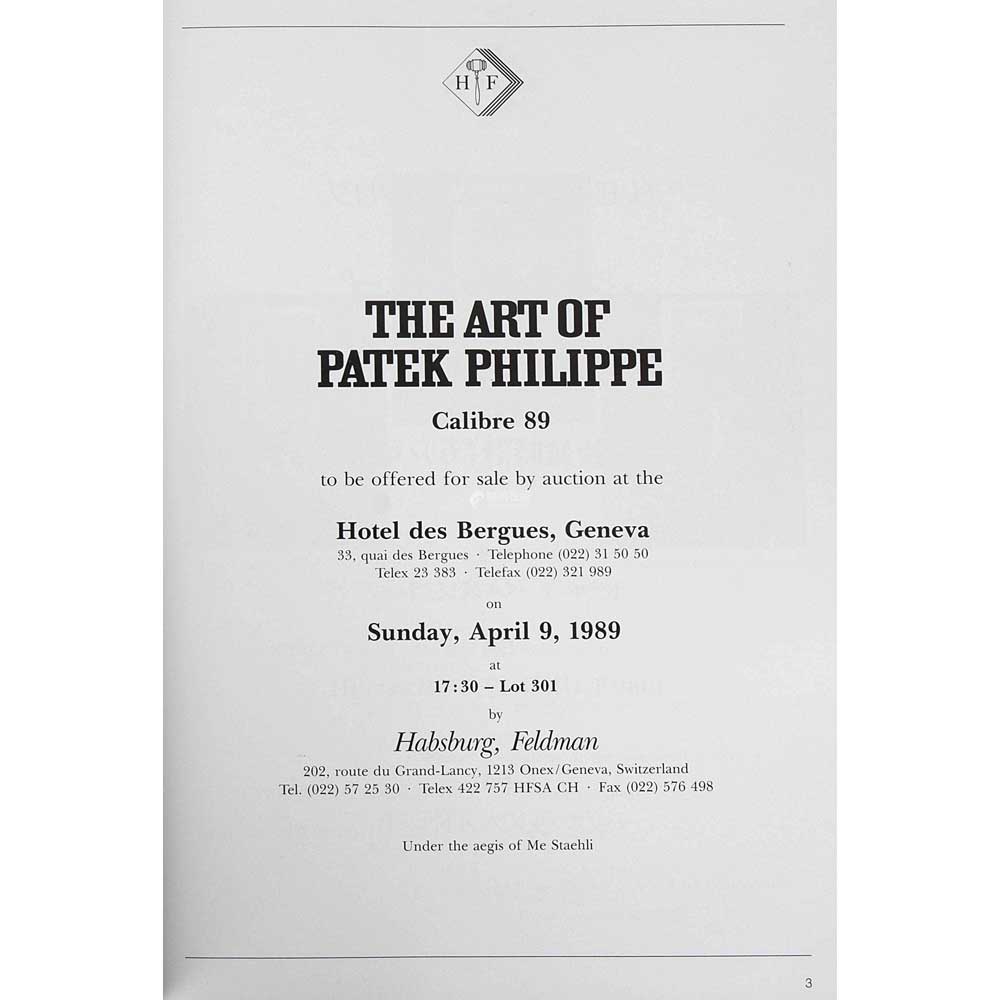

The Art of Patek Philippe, a mono-thematic auction organised by Patrizzi in 1989 offered a specially curated selection of 301 watches that fetched USD 15 million.

Patek Philippe introduced the reference 3960 in 1989 to commemorate the firm’s 150 anniversary.

A legendary unicorn, the platinum ref. 1415 HU showed up in the market again this year as part of Christie’s The Legends of Time, an auction of some of the most remarkable timepieces from the 19th and 20th century. Estimated to sell for between HKD 8,000,000 and HKD 24,000,000, the watch finally went under the hammer for HKD 14,650,00 (approximately USD 1.8 million) on May 22. Given the rarity of this timepiece, most experts feel that the piece could have done much better but the changing nature of auctions and the current trends determined otherwise. “The price for this watch seemed to be an outlier in 2002. Maybe it was the perfect storm of a brilliantly persuasive specialist auctioneer fueling the paddle of a deeply pocketed, aggressive buyer — literally it was the right watch at the right time. And when we saw this exact same watch appear at Christie’s recently, many hoped to see it bring more, but it sold for ‘only’ USD 1.8 million the second time around. Still impressive but not so subtle a reminder that not all objects will go up in value, even in a white-hot market,” says John Reardon, a leading authority on Patek Philippe watches, and the founder of Collectability.

A legendary unicorn, the Patek Philippe platinum ref. 1415 HU sold for a record breaking CHF 6.6 million in 2002.

The platinum ref. 1415 HU showed up in the market again this year as part of Christie’s The Legends of Time, an auction of some of the most remarkable timepieces from the 19th and 20th century.

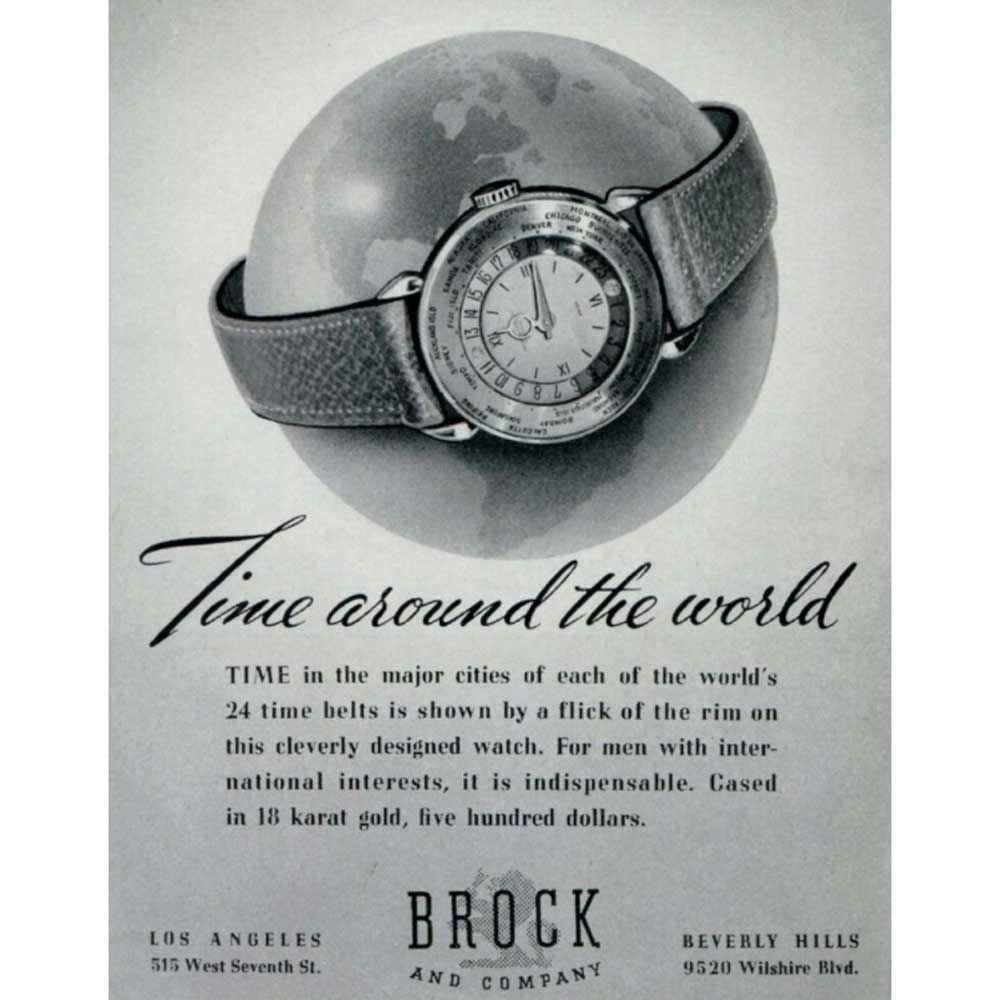

An old advertisement for Patek Philippe world timers (Image: Collectability)

Buoyed by an unprecedented interest in vintage watches from South Asian collectors and millennials in particular, watch auctions have undergone a sea change over the last two decades. The rise of new millionaires, social media and transparency in information on collectible timepieces has redefined the status of “grail” watches and “unicorns.” While Patek Philippe was the most dominant player at auctions in the 1990s, the 2000s catapulted Rolex to the pole position along with Patek, and now we see an emergence of independent brands among top lots at leading auction houses. According to Reardon, as the auction market accelerated its global turnover from USD 70 million in 1998 to well over USD 300 million in 2020, auction houses started to attribute newer meanings to “grail” watches. “There are only so many holy grail watches to feed the hungry market. With a short supply of complicated Pateks and superlative pocket watches, auction houses needed to find alternative offerings as cover lots. So we saw the emergence of vintage Rolex creeping onto cover after cover of the auction houses, and not surprisingly more modern contemporary pieces taking center stage.” says Reardon.

John Reardon, founder of Collectability, a website that trades exclusively in all things Patek.

“Twenty years ago, it may have been the strong opinion of a watch auction specialist that defined the supply and importance of a watch. Now, as the market becomes more transparent, we are seeing the very definition of a grail watch changing, seemingly on a weekly basis. The demand side of the equation is changing faster than the auction houses can print a catalog,” he says.

The Changing Landscape for Auctions

Until a few years ago, online sales were a major sore point for auction houses. But with millennials joining the traditional watch collecting community, socially distant bidding started to pick up and finally when the pandemic flipped the switch for e-retail for luxury watches last year, auction houses expanded their offerings to woo first-time buyers as well. Today, more people are learning, comparing, buying and selling watches than ever before. The market is becoming less opaque, information is being shared, and the grails of the future are being pursued by a new generation of collectors that are learning to collect by their own set of rules. The generational shift in buyers is obviously pushing auction houses to bring in more transparency, flexibility, diversity and sustainability in their business models.

During the first five months of 2021, the average price of a lot sold online was pegged at CHF 9,816, as compared to live auctions that would command CHF 57,943.

According to Thierry Huron, founder of The Mercury Project, a Swiss watch and jewelry consulting firm, the current generation of watch enthusiasts are poles apart from collectors who have been around for the last 20 years. “The demographic for watch collectors under 40 are getting into watch collecting these days. For instance, if you look at Sotheby’s clientele, the number of Singaporean buyers aged under 40 went up from 12 percent in 2017 to 29 percent last year. Christie’s recent auction in Dubai registered 558 participants online from 37 countries. Of these, there were first-time buyers from countries like Norway, Ethiopia and Uganda. Phillips’ Hong Kong Watch Auction XII also reported a 30 percent increase in online participants as compared to the last season,” he says.

During the first five months of 2021, the average price of a lot sold online was pegged at CHF 9,816, as compared to live auctions that would command CHF 57,943. “Online auctions offer a different category, more adapted to the demand,” explains Huron. While Patek Philippe and Rolex continue to rule the auction scene even with the younger clientele, the demand for larger, sportier models from these brands has gone up as compared to the dressier variants preferred by the older generation of collectors. The two brands accounted for 75 percent of the value of lots sold above CHF 100,000 until May 2021.

Thierry Huron, founder of The Mercury Project, a Swiss watch and jewelry consulting firm

Eric Wind, owner of Wind Vintage

“It was only 10 years ago that Christie’s sold a vintage Rolex for over USD 1 million for the first time. Since then, there have been at least 30 more watches that have sold for over USD 1 million at auctions and many more that have traded privately above the same amount. This, I would say, is the biggest change in auctions then and now,” says Eric Wind, owner of Wind Vintage. “Newer buyers are specifically looking for condition and originality in sportier steel watches. For example, the Patek Philippe reference 570 in steel with Breguet numerals that was recently sold by Phillips for CHF 3.3 million is not a unique watch. It was essentially seen as a beautiful watch in a large size, and it sold for twice the value of the reference 1415 HU in platinum. Of course, everyone loves having a unique watch, but a beautiful watch in a great condition is considered more important than rarity these days. As I often tell groups when speaking about vintage watches: condition, condition, condition trumps rarity, rarity, rarity,” he says.

According to Eric Wind, newer buyers are specifically looking for condition and originality in sportier steel watches. Seen here is the Rolex Cosmograph Daytona ref. 16516 with a ‘Tiffany blue’ lacquered ‘Stella’ dial

The Patek Philippe reference 570 in steel with Breguet numerals was recently sold by Phillips for CHF 3.3 million

Phillips’ Hong Kong Watch Auction XII reported a 30 percent increase in online participants as compared to the last season

At the turn of the century, as watch auctions got more sophisticated with thematic sales, captivating catalogs and fancy previews over cocktails, the buyers’ profile also started getting diverse. This was the period when auction houses renamed their sales from simply “Watches” to “Important Watches” and “Rare Watches.” Says Reardon, “The auction catalog covers from this era graphically tell the story of what were considered as the most coveted watches. We also started to see longer footnotes in the pages of these catalogs. Earlier, many buyers were expected to know what was rare and important, but increasingly the auction houses learned to spoon-feed information with long and elaborate footnotes. The idea was that an educated consumer would bid more — and bid more they did.“

Twenty years on, auction houses are out to woo a much younger audience looking to buy storied timepieces with a perceived liquidity. Their high-ticket purchase has to have social approval, and this is where the changing perception of “rarity” comes into play. “Today most people are looking for almost new old stock vintage watches and not so much for rarity in a timepiece. This explains why the ref. 1415 in pink gold, which did comparatively better than the unique piece in platinum, which was bought by an Asian buyer in his thirties. Asian collectors prefer pink gold watches over platinum any day. Sure, the 1415 in platinum is a very rare watch, but the current generation of buyers are not necessarily putting their money on historically important pieces. They are used to wearing heavy and impactful watches like Audemars Piguet, so a small-sized platinum watch doesn’t attract them in the same way. It is a psychological gap between the collectors then and now,” explains Alexandre Bigler, vice president and head of watches for Christie’s Asia Pacific.

Alexandre Bigler, vice president and head of watches for Christie’s Asia Pacific

According to Bigler, Asian collectors prefer pink gold watches over platinum. Seen here is the Patek Philippe ref. 1415 in pink gold

Patek Philippe ref. 3448 “Alan Banbery”, which was specially modified in 1975 as a unique piece for presentation to Alan Banbery sold for USD 3.7 million at Christie’s this year

Christie’s blockbuster Legends of Time attracted world record prices for 10 lots, eight of them Patek Philippes, along with a Rolex and an F.P. Journe. Besides the one and only ref. 1415 in platinum, the auction also included an exceptionally unique ref. 3448J “Senza Luna.” Manufactured in 1970, this watch was modified by Henri and Philippe Stern in 1975 at the request of their director of sales, Alan Banbery. While the initial estimate for this piece was between USD 3.2 million and USD 5 million, it finally went under the hammer for USD 3.7 million — a world record for the reference. “It is a watch that appeals to intellectuals. You need to have a deep understanding of Patek Philippe and Banbery’s role in the company to appreciate this watch. We are quite happy with the price achieved for this piece. I would say the results are healthy and it is not a crazy, volatile growth,” says Bigler.

Unicorns: Then and Now

At Phillips’ Geneva Auction XIII, the Patek Philippe ref. 2523 set the record both for a two-crown world time watch (with a cloisonné enamel dial) and for any yellow gold wristwatch sold at auction.

Rare can mean many things for different people: it can mean a watch that has been produced in only very small quantities, or a watch that is hard to buy at retail due to long waiting lists. According to Alexandre Ghotbi, head of watches for Phillips in Continental Europe and the Middle East, the perception of what is rare or a unicorn has not changed per se but has shifted partially to different types of watches. “We see a younger generation of watch collectors coming to the market, mainly from Asia and the Middle East, and they are looking for the ‘unicorns’ of their generation, in addition to collectible watches that remain coveted regardless of the age of the buyer such as Patek Philippe complicated pieces (refs. 1518, 2499, 2523, etc.) or rare Rolex Daytonas or triple calendar models (such as refs. 6062 or 8171). We see the rise of watchmaking from the 1980s to 2000s, the incredible rise of independent watchmaking and timepieces that are quirky and different. The market for collectible watches has greatly expanded and is no longer the playground for the three or four brands that were leading the auction market for so long,” he says.

Alexandre Ghotbi,Phillips head of Watches, Continental Europe, and Middle East director

The Rise of the Independents

A complete set of F.P. Journe "Souscription" watches to be sold By Phillips in Geneva in November

Looking for an exceptional mix of incredible design and old school watchmaking know-how, the new-age collectors are increasingly turning to the independent brands for handmade, complex timepieces with distinct aesthetics. Most of these connoisseurs already have a Daytona or two in their closet and are ready to experiment with watches that would catch the attention of their peers on social media. “I think there is a fantastic overlap between vintage timepieces and independent watchmaking including ultimate rarity, craftsmanship and a lack of over marketing in the stories. It’s a natural step for vintage collectors to go towards independents and for collectors of independents to go towards vintage,” says Ghotbi. “The independents as a ‘genre’ have become the famous ‘third brand’ that has managed to join the two auction behemoths that are Patek Philippe and Rolex, who have been leading the watch auction market for decades,” he says.

Back in 2019, Phillips was one of the first auction houses to create a dedicated segment for the independent watchmakers. It also held traveling exhibitions to promote these brands and today, some of the top headliners at Phillips include watches from Philippe Dufour, F.P. Journe and Laurent Ferrier. “In June 2020, we sold the F.P. Journe Tourbillon Souscription for a record price at USD 1,476,720. Then in November, we made another record for a Philippe Dufour Simplicity Anniversary Edition number 00 in pink gold. The watch was sold for USD 1,512,000, the highest price paid for an independent maker at any auction.

In November, Phillips sold a Philippe Dufour Simplicity Anniversary Edition number 00 in pink gold for USD 1,512,000, the highest price paid for an independent maker at any auction

The rise of independents brings color, flavor and greater variety t0 the table,” says Ghotbi. The rise of independent watch brands is a refreshing development over the past decade from a horological perspective. Many rising stars of the watch world continue to push the limits of creativity and know-how to new heights. However, Reardon feels that the marketplace is getting spoiled with many people buying watches for purely monetary gain. He says, “The ultimate expression of what is wrong with the market today is how speculative buying trends are driving prices into bubble territory with a select few references. The best example is the resale value of the green dial steel Nautilus. The watch retails today for USD 33,000, and the resale value is well over USD 300,000. There is no logic to this beyond a social media driven mania. The same is true with some resale prices we are seeing for some independent watches.”

The green-dialled stainless steel Nautilus ref. 5711/1A-014

We can’t begin to guess where this is all going, but we can be sure that there are still watches today that can be bought for incredible value for those that follow their hearts and minds. Says Reardon, “My advice in this crazy market is to buy with your heart as much as your mind. This mantra has served collectors well for many years. You should decide what your grail is and not let others tell you what your grail should be.”