Blancpain

Road to Recovery: Richemont, Swatch Rebound to Pre-COVID Sales

Blancpain

Road to Recovery: Richemont, Swatch Rebound to Pre-COVID Sales

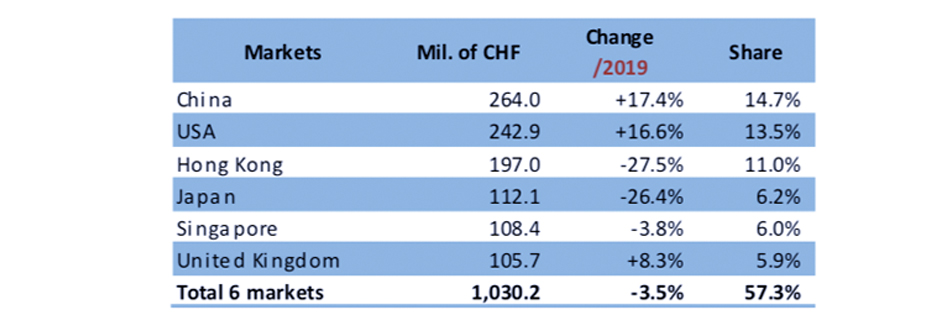

After a long slump, the Swatch group has reported profit in the first six months of 2021 with sales witnessing a jump of more than 50 percent. Thanks to a strong demand for its prestige brands like Harry Winston, Omega and Blancpain, the Swatch Group is boasting a net profit of 270 million Swiss francs compared with a 308 million franc loss in the same period of last year.“Based on the significantly accelerated increase in sales in the second quarter, particularly in the month of June, the Swatch Group anticipates further strong growth in local currencies in the second half of the year, with sales above 2019 levels,” the company forecasts.

Hayek’s optimism is certainly not misplaced as more and more shoppers returned to brick and mortar stores in July in countries like China, Russia and the U.S. “We’re seeing an acceleration month-to-month, where we approach 2019 levels more and more or even exceed them sometimes,” said Hayek, who might even introduce more stores in the second half of the year.

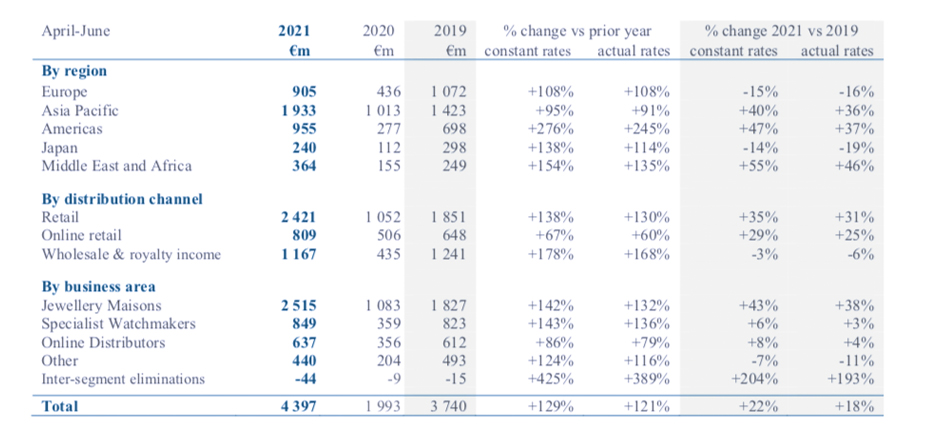

The main drivers of this year’s boomlet for Richemont are the Americas, Asia Pacific and the Middle East that reported double-digit increase in sales. While sales in the U.S. market touched a hearty €955 million (47 percent up from 2019), the Middle East and Africa posted the strongest regional performance with 55 percent growth in sales, reflecting the buying power of the locals in Dubai and Saudi Arabia.

The main drivers of this year's boomlet for Richemont are the Americas, Asia Pacific and the Middle East that reported double-digit increase in sales.

The momentum towards recovery caught speed with a strong community of watch enthusiasts who brought their tribe online to propel discussions around collecting. Digital media also played a crucial role in encouraging people to research and buy watches online all through last year. Richemont’s online distributors, the division of Net-A-Porter, Mr Porter and Watchfinder saw sales rise 86 percent since last year.

The second half of the year for Richemont will usher in some management changes as well. Cyrille Vigneron, President & Chief Executive of Cartier, and Nicolas Bos, President & Chief Executive of Van Cleef & Arpels, will step down from the Senior Executive Committee and will not seek re-election to the Board of Directors at the Group’s Annual General Meeting (‘AGM’) in September.

“The continual evolution of our corporate governance structures reflects our commitment to meet the changing demands of our operating environment most efficiently and align with best practice. While the enlarged SEC structure proved effective in the early stages of our transformation journey and in navigating one of the most trying times in recent history, the time is ripe for a more streamlined structure as we embark on the next stage of our development. The outstanding development of Cartier and Van Cleef & Arpels, in particular, means that these businesses have reached a size and scale that require the full attention of their leaders and support of the Group to continue on their remarkable trajectory,” said Richemont’s Chairman, Johann Rupert. “Throughout the pandemic, agility and well-informed rapid decision making have been essential. Decisions must be made as close as possible to customers. These governance changes will allow Maison and business executives to focus exclusively on their customers, colleagues, partners and the sustainable development of their entities at a time when the world is changing rapidly and growing in complexity,” he said. Johann Rupert, Jérôme Lambert and Burkhart Grund, Chief Finance Officer, will remain on the Senior Executive Committee and will stand for re-election to the Board of Directors at the AGM.

Swiss watch exports in May reached 1.8 billion francs, which is +174.2 percent compared with May 2020.