The latest report illuminates the state of the Swiss watch industry in 2024.

The Swiss watch industry concluded the year on a positive note, achieving record sales totaling CHF 26.7 billion, with CHF 25.5 billion attributed to wristwatches (+7.7%) sold in a total of 16.9 million units. Initially, this appears to be very positive news. However, the latest annual report published by

Morgan Stanley and

LuxeConsult provides a more detailed and nuanced analysis, revealing a tale of two halves.

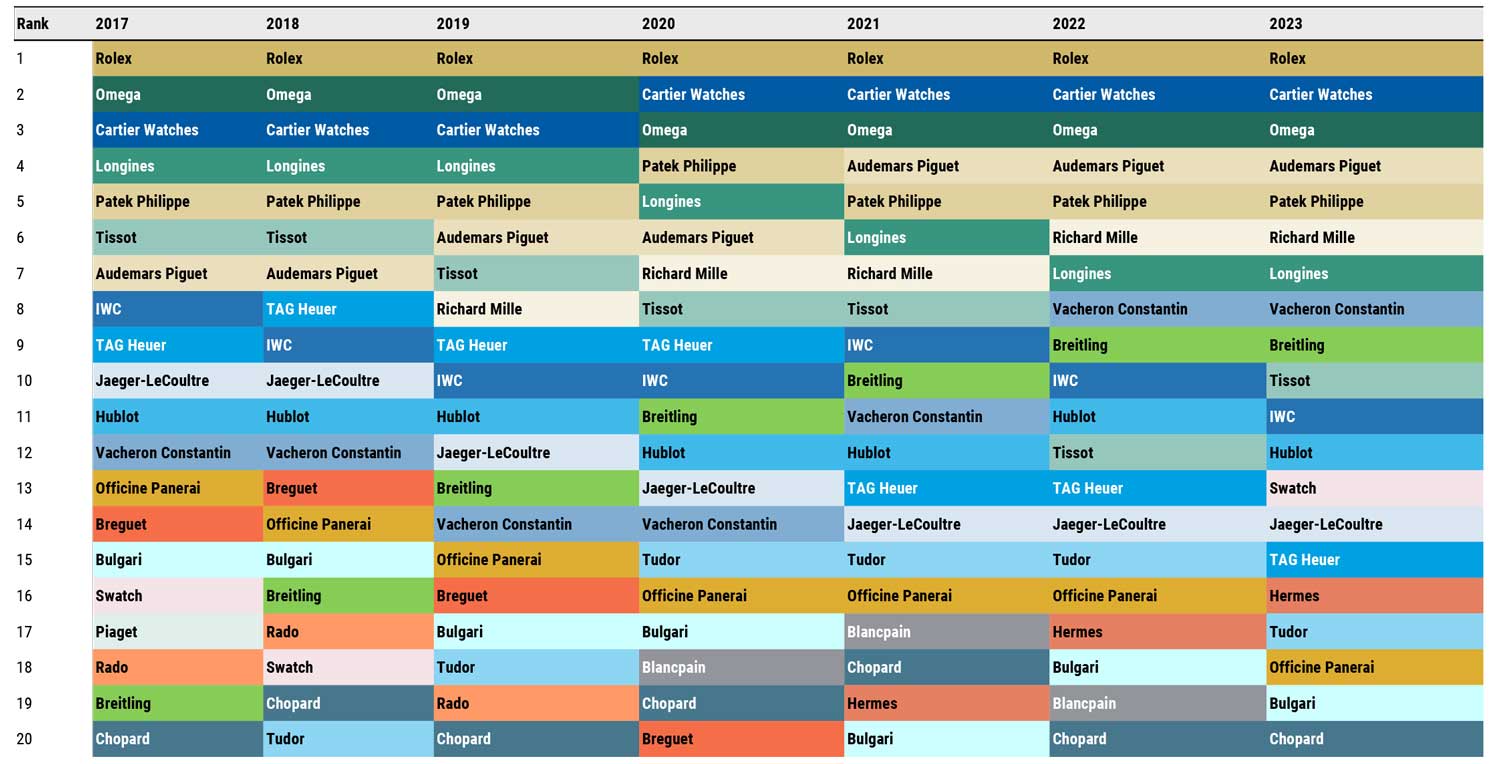

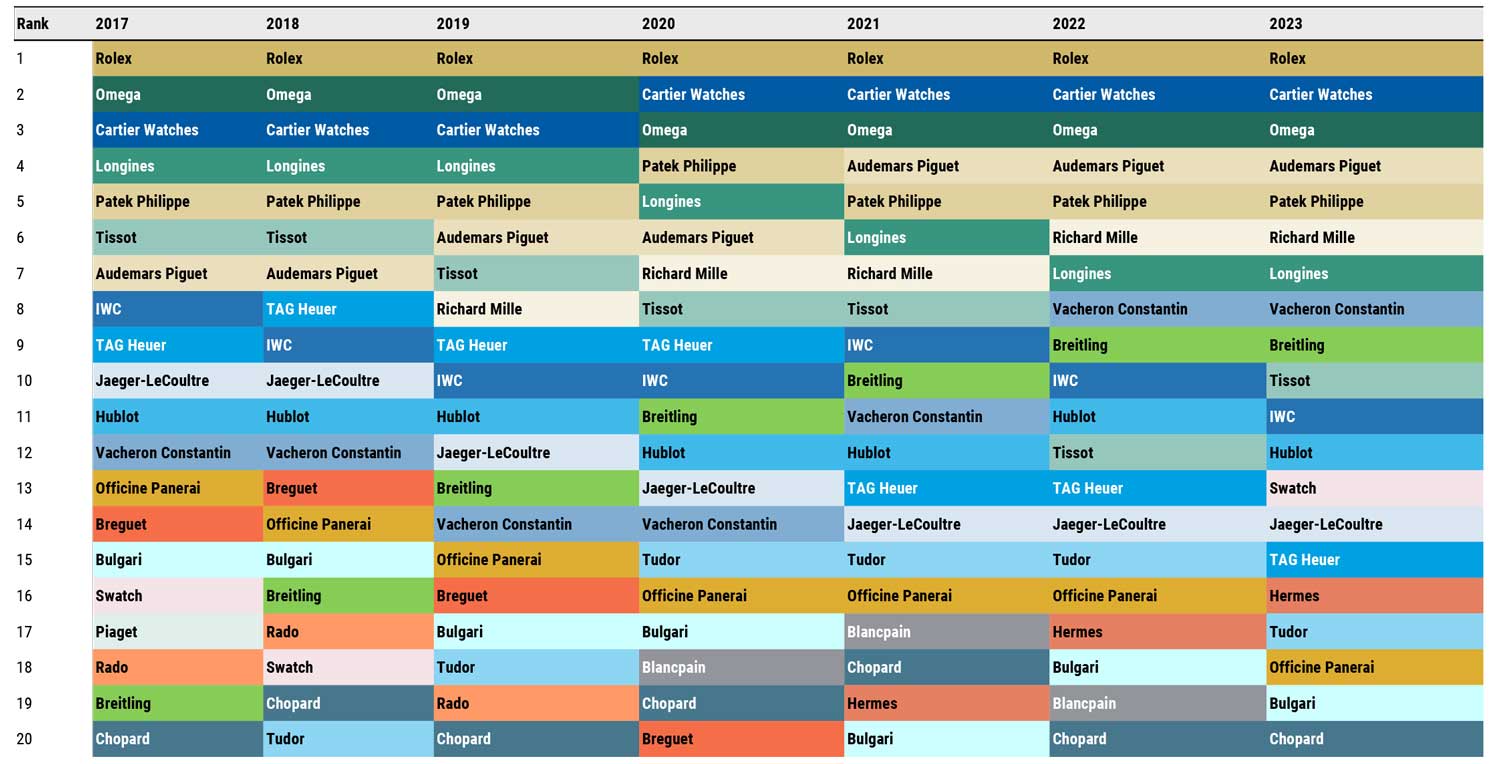

Rolex, Patek Philippe, Audemars Piguet, and Richard Mille solidify dominance

Source : LuxeConsult, Morgan Stanley Research estimates. Note: this chart cannot be reproduced without Morgan Stanley’s express authorization

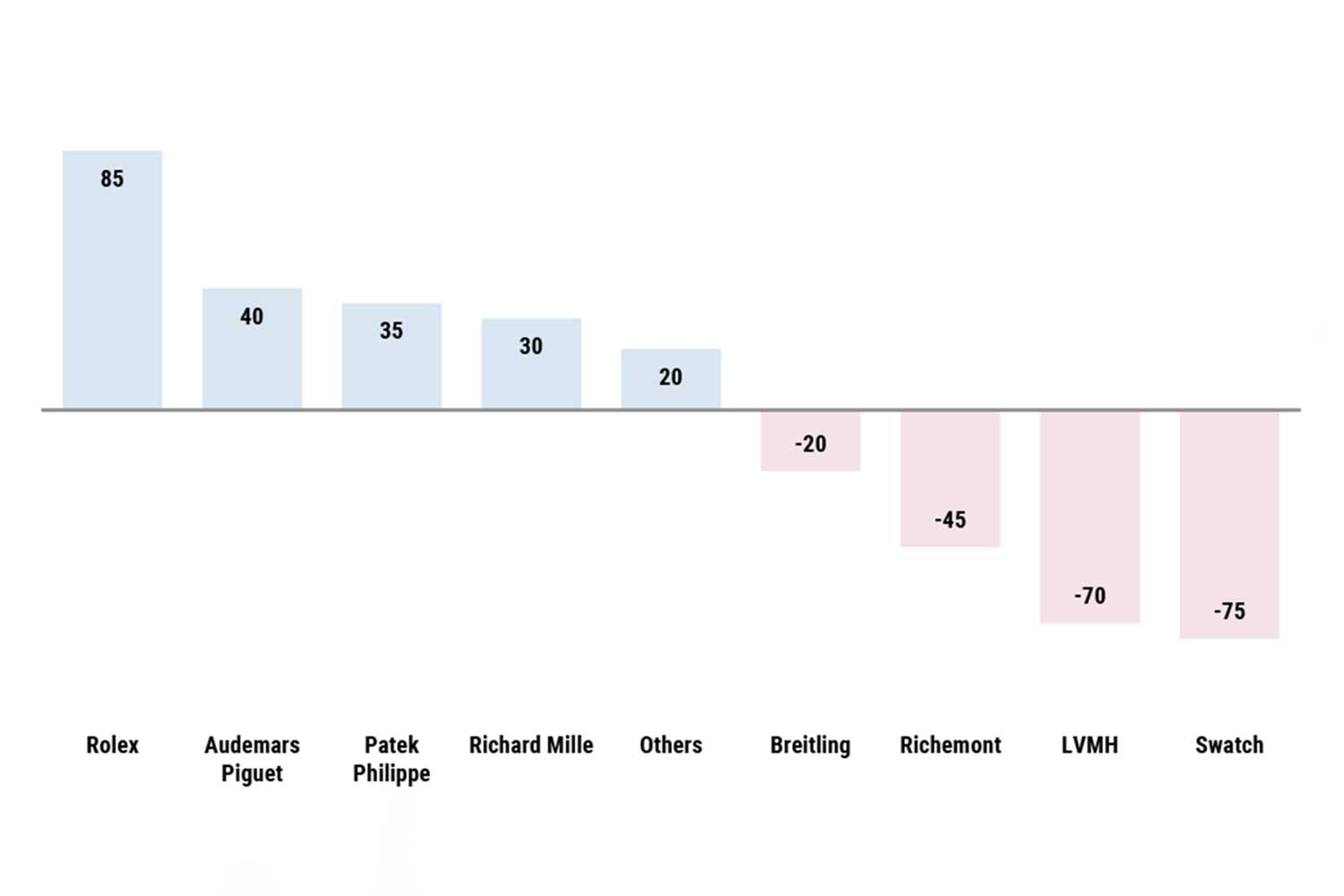

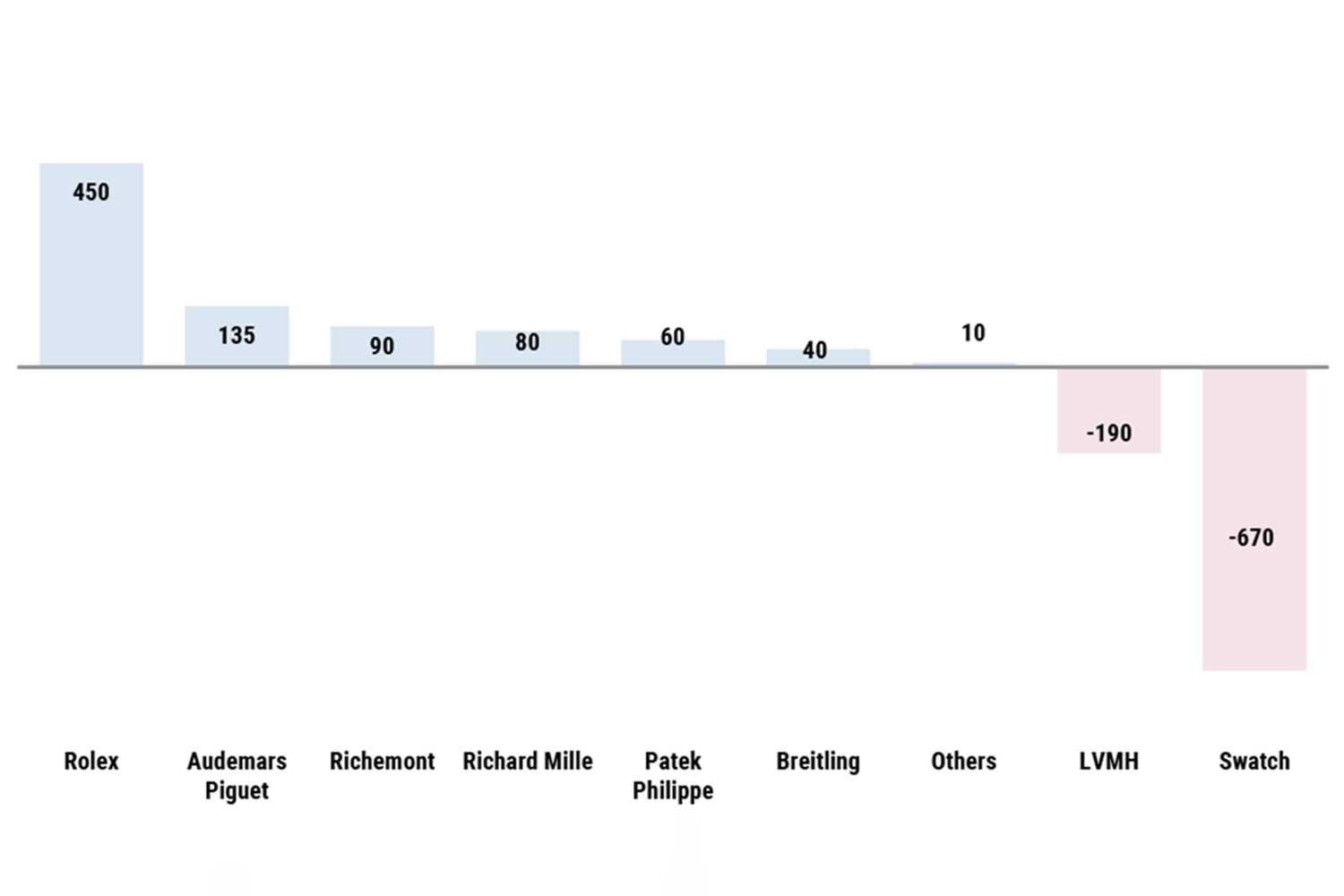

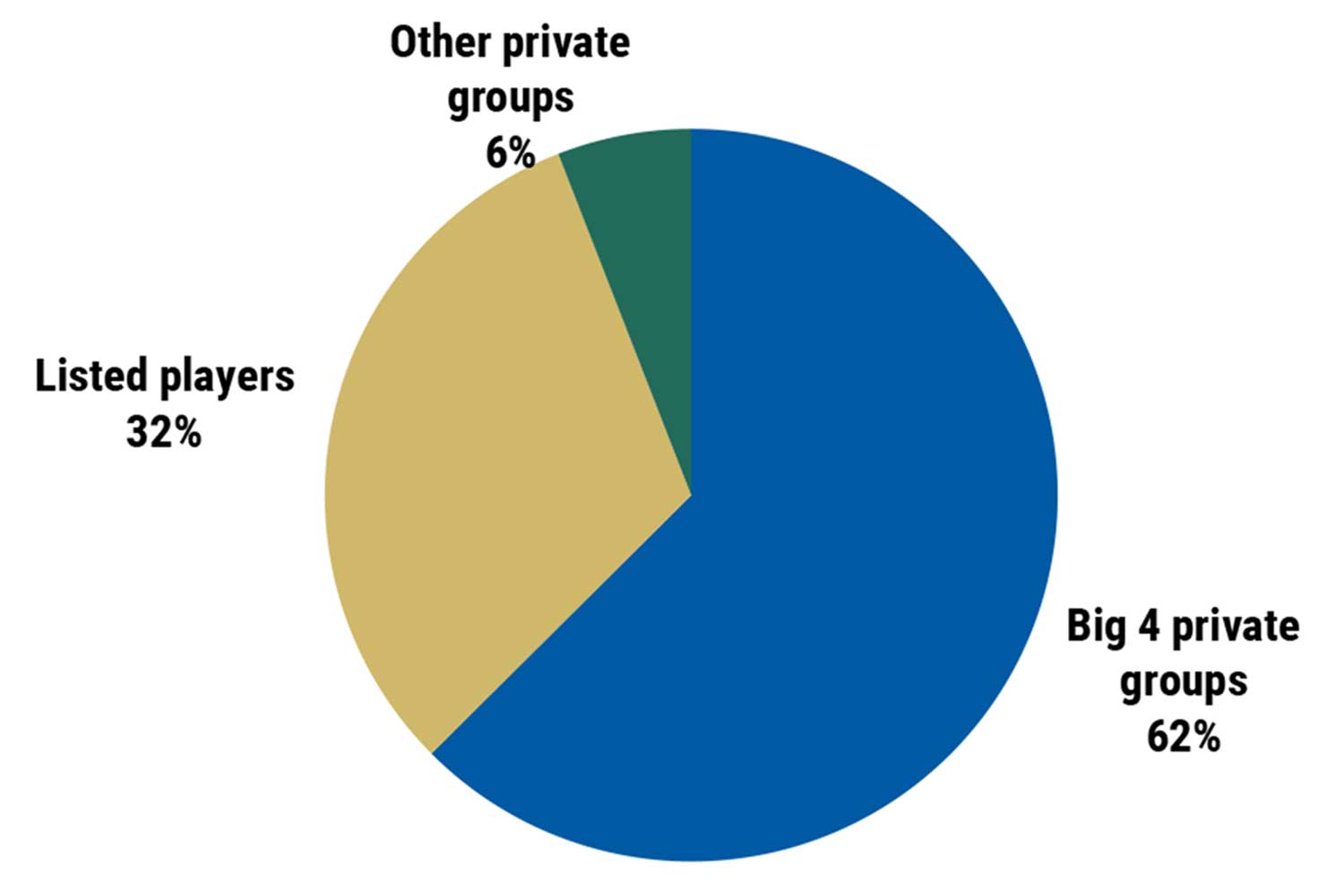

The dominance of the “Big Four” luxury watch brands—Rolex, Patek Philippe, Audemars Piguet, and Richard Mille—strengthened, gaining +203 basis points and securing an impressive combined 43.9% market share. This acceleration of a long-term trend becomes evident when compared to pre-Covid 2019, with an increase of +693 basis points from 2019’s 36.9%.

Rolex makes history by exceeding CHF 10 billion in sales

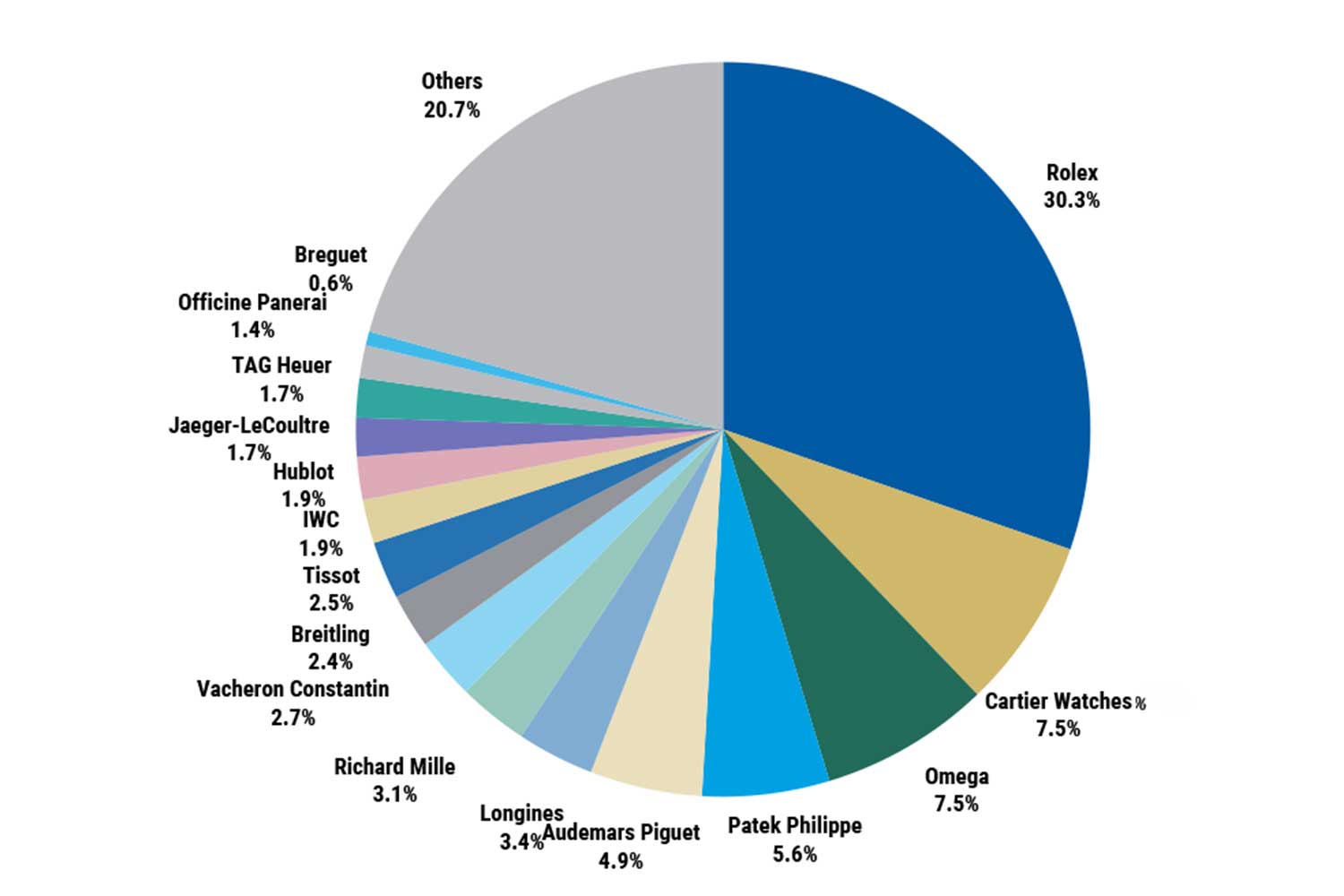

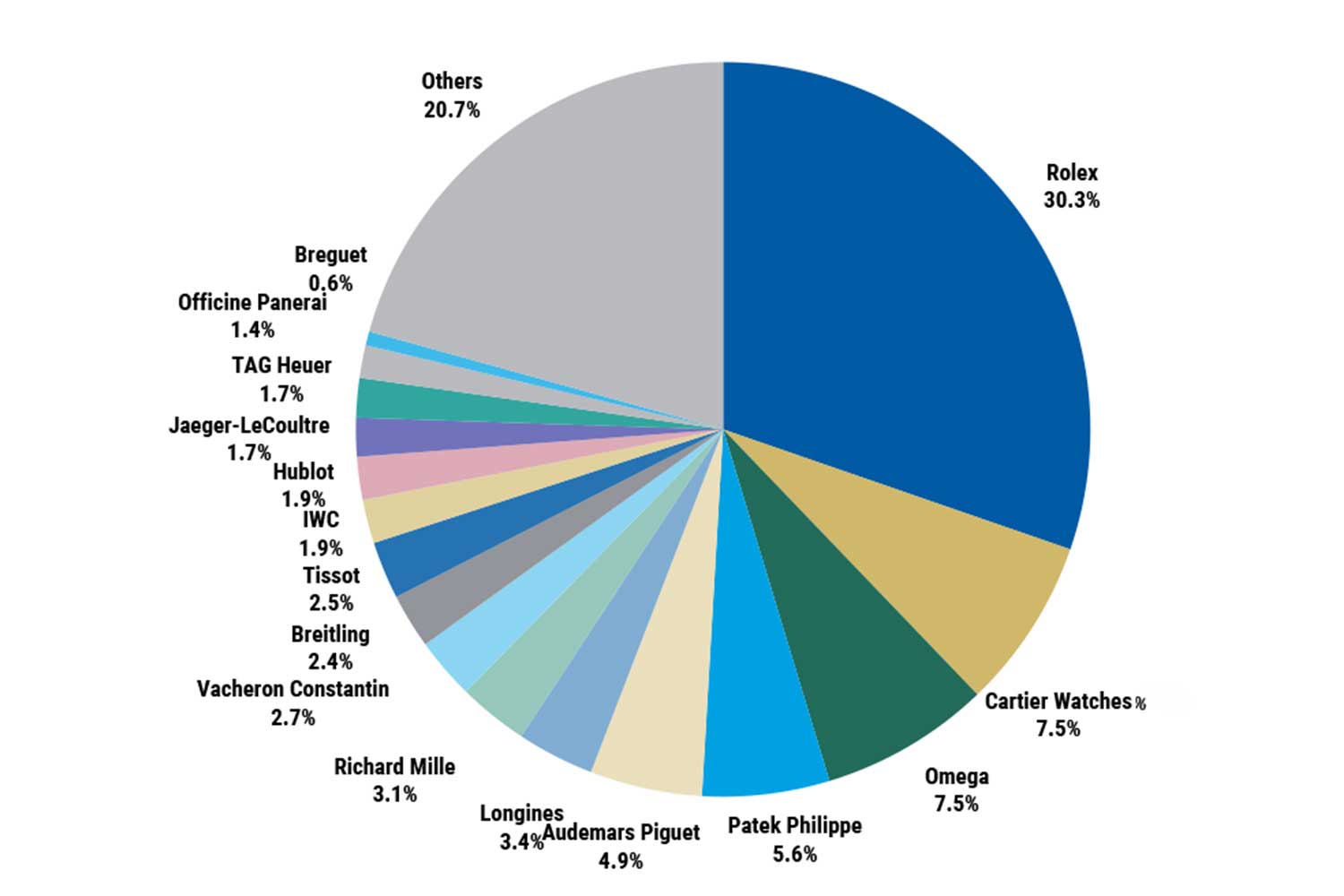

Swiss watches: Estimated retail market share by brand in 2023

Source : LuxeConsult, Morgan Stanley Research estimates. Note: this chart cannot be reproduced without Morgan Stanley’s express authorization

Rolex has made history by becoming the first Swiss watch brand to surpass the CHF 10 billion threshold in sales. Additionally, it has strengthened its dominant position in the market, capturing a remarkable 30.3% share of the retail market. No other luxury brand can boast such a commanding presence in its product segment.

Vacheron Constantin is a new member of the Billionaires’ Club

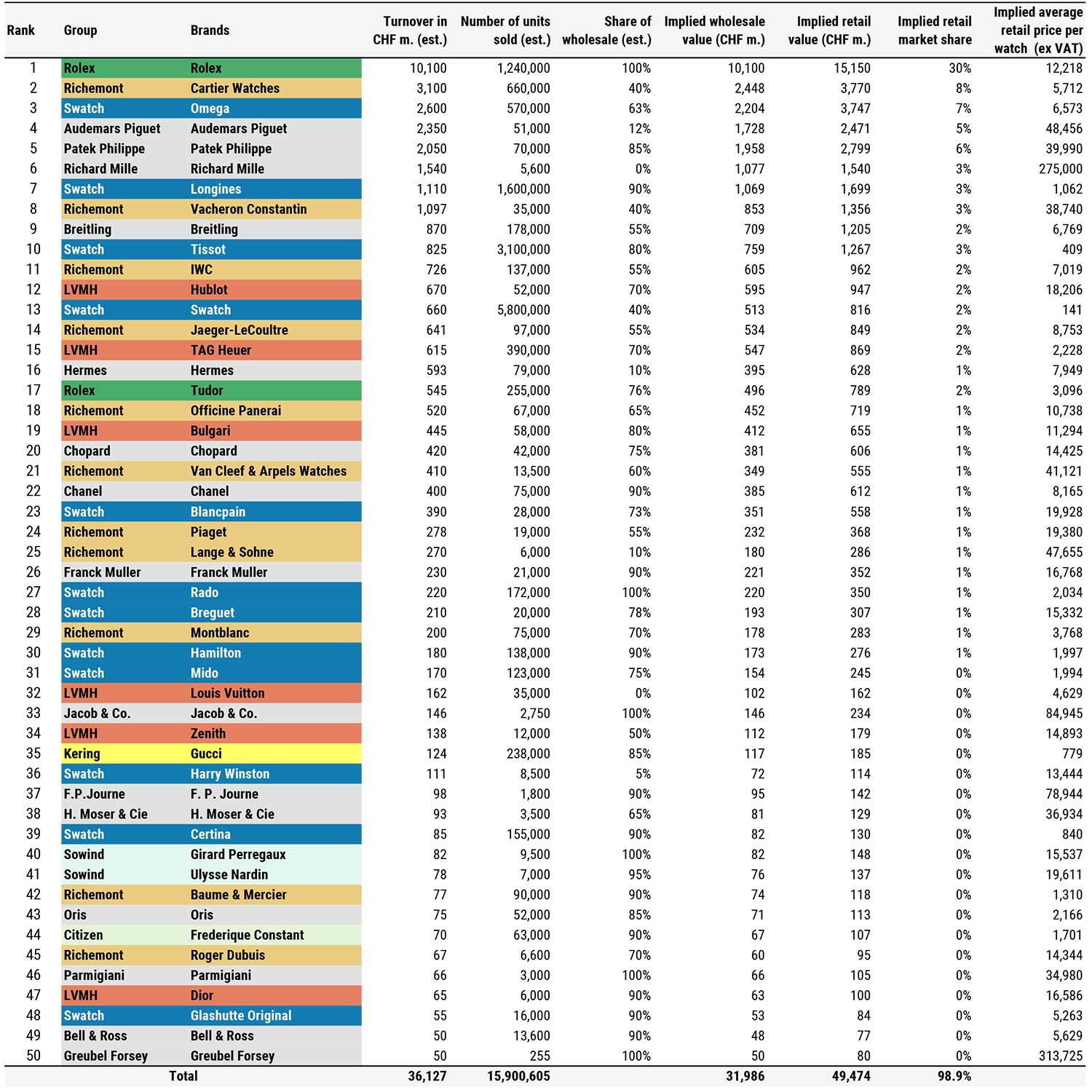

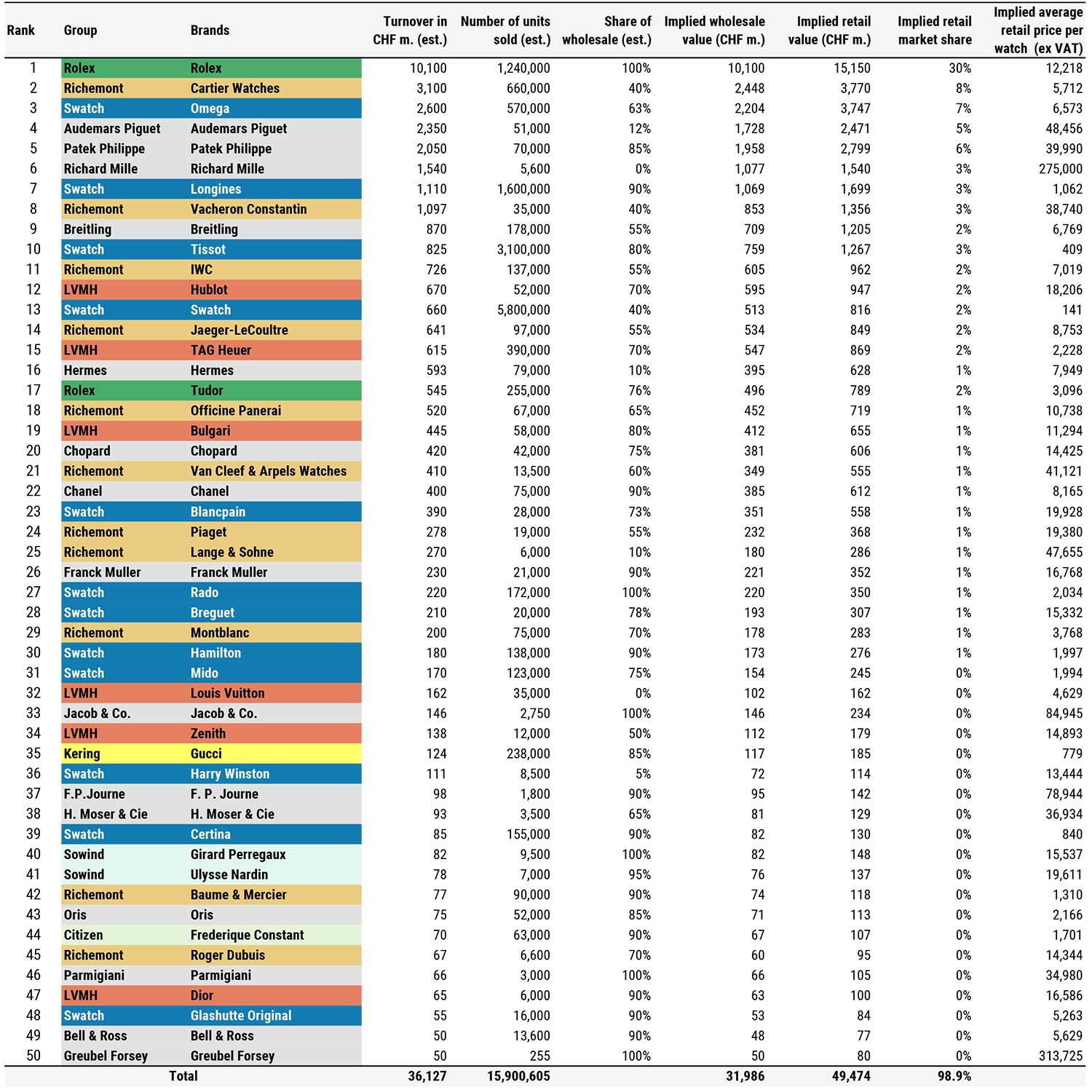

Swiss watch brands: our estimates of the top 50 brands’ turnover and retail/wholesale values in 2023

Source : LuxeConsult, Morgan Stanley Research estimates. Note: this chart cannot be reproduced without Morgan Stanley’s express authorization

Vacheron Constantin has joined the ranks of the billionaires’ club as the 8th brand to surpass CHF 1 billion in sales, reaching CHF 1.097 billion with an 18% increase. Additionally, the brand gained a 24 basis point increase in market share. However, with a retail market share of 2.7%, it still trails behind its direct competitor Patek Philippe, which stands at 5.6% (+32 basis points).

An analysis of specialty watchmakers at Richemont

Within Richemont, the performance of specialty watchmakers varied, with three brands—Vacheron Constantin, A. Lange & Söhne, and Van Cleef & Arpels—gaining market shares. However, a significant concern for the division is IWC, which experienced a 13% decline in sales, estimated at CHF 726 million.

This decline is attributed to the brand’s increasingly mispositioned pricing, despite launching compelling new products, such as the revived Ingenieur watch, the retail prices remain ambitious. Direct competitors like Omega and Breitling offer more competitive value propositions.

Cartier watches slightly underperformed compared to jewelry, achieving an 8% increase in sales at CHF 3.1 billion, compared to jewelry’s 11% increase. However, it outperformed the industry average and gained market shares by 5 basis points.

For the first time, Cartier’s retail market share surpassed that of Omega, reaching 7.54% compared to Omega’s 7.49%.

Rolex, Cartier, Omega, and Patek Philippe lead Swiss watch sales

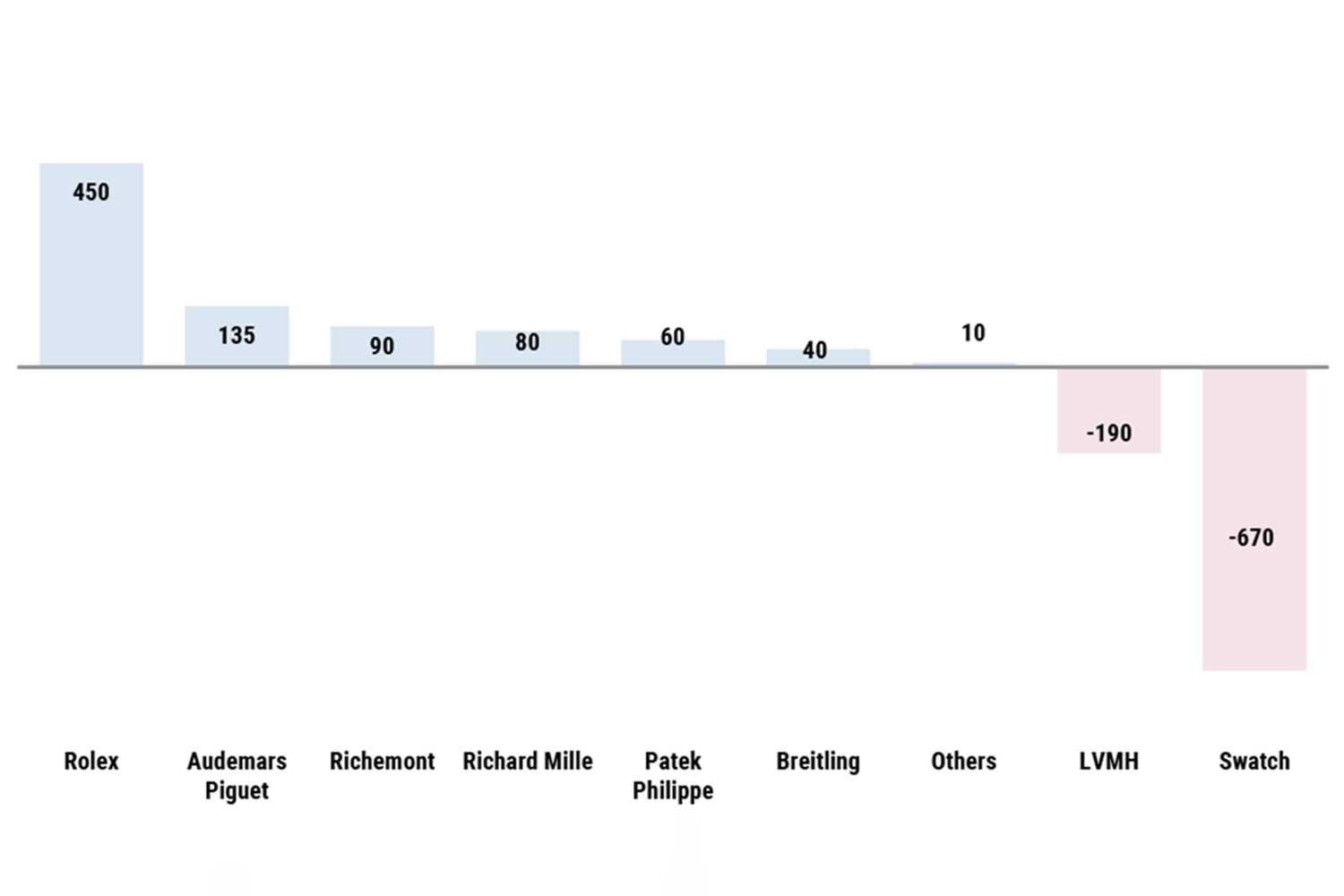

Swiss watch revenue pool 2023

Source : LuxeConsult, Morgan Stanley Research estimates. Note: this chart cannot be reproduced without Morgan Stanley’s express authorization

The Swiss watch industry sees significant dominance from just four brands, namely Rolex, Cartier, Omega, and Patek Philippe, which collectively contribute to 50.2% of total sales. Furthermore, a mere thirteen brands encompass 75% of the market, while 90% of Swiss watch sales are attributed to only twenty-five brands out of approximately 350 in total.

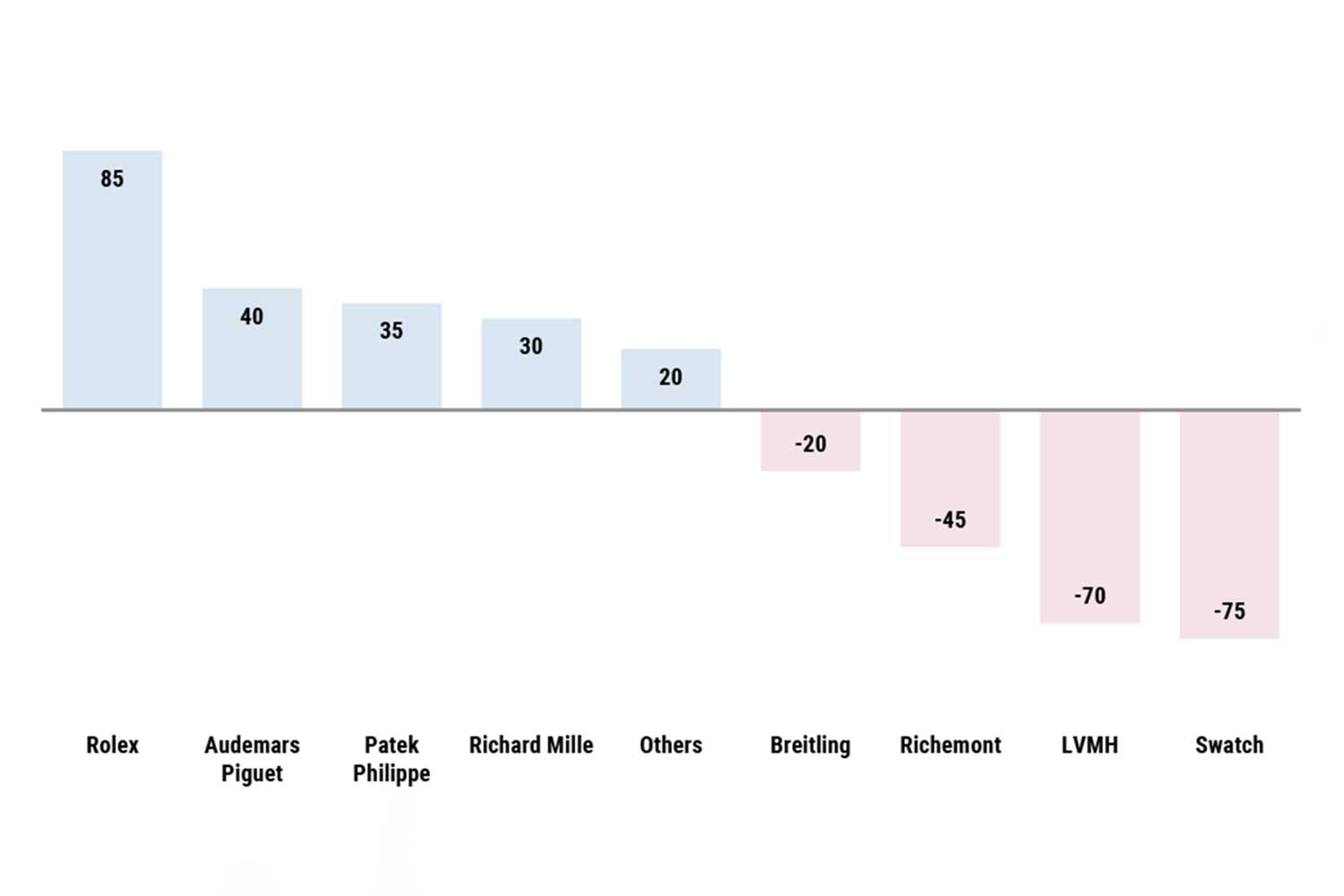

Swatch Group’s market performance and notable exceptions

Despite an overall decline in market shares (-75 basis points), Swatch Group saw significant success in two areas. Swatch experienced a notable increase of 55 basis points, moving from #22 to #13 in 2019, largely due to the continued

popularity of the MoonSwatch, which sold over 2 million units last year.

This success accounted for 73% of the brand’s sales, totaling CHF 660 million, representing a remarkable 63% increase year-over-year, marking the largest gain among all brands in the top 50. Additionally, Tissot’s recovery was fueled by the success of the PRX product family and the reopening of the Chinese market.

This led to a 14% growth in top-line revenue, reaching CHF 825 million, or a 21.4% increase at constant exchange rates.

Premiumization trend drives growth

Premiumization continues unabated, with watches priced over CHF 25,000 driving 69% of the growth and constituting 44% of the total value of Swiss watch exports. However, despite its significant value contribution, this segment represents only 2.5% of the total volume in units.

Swatch Group is the primary contributor to volume in the entry and midlevel price segments, holding an overall volume share of 72%.

Estimated change in market share in 2023 vs. 2022 by Group

Source : LuxeConsult, Morgan Stanley Research estimates. Note: this chart cannot be reproduced without Morgan Stanley’s express authorization

Estimated change in market share in 2023 vs. 2019 by Group

Source : LuxeConsult, Morgan Stanley Research estimates. Note: this chart cannot be reproduced without Morgan Stanley’s express authorization

The entry-level price point is impacted by smartwatches

As the entry price range continues to be impacted by smartwatches (among other factors), a total of approximately 80 million advanced smartwatches (~140 million overall) were sold around the world in 2023. This compares to a total of 16.9 million Swiss watches that were exported last year. Swatch and Tissot are the two exceptions defending this price segment of traditional watches against smartwatches, fashion brands and crowd-funded micro-brands.

Key winners in 2023

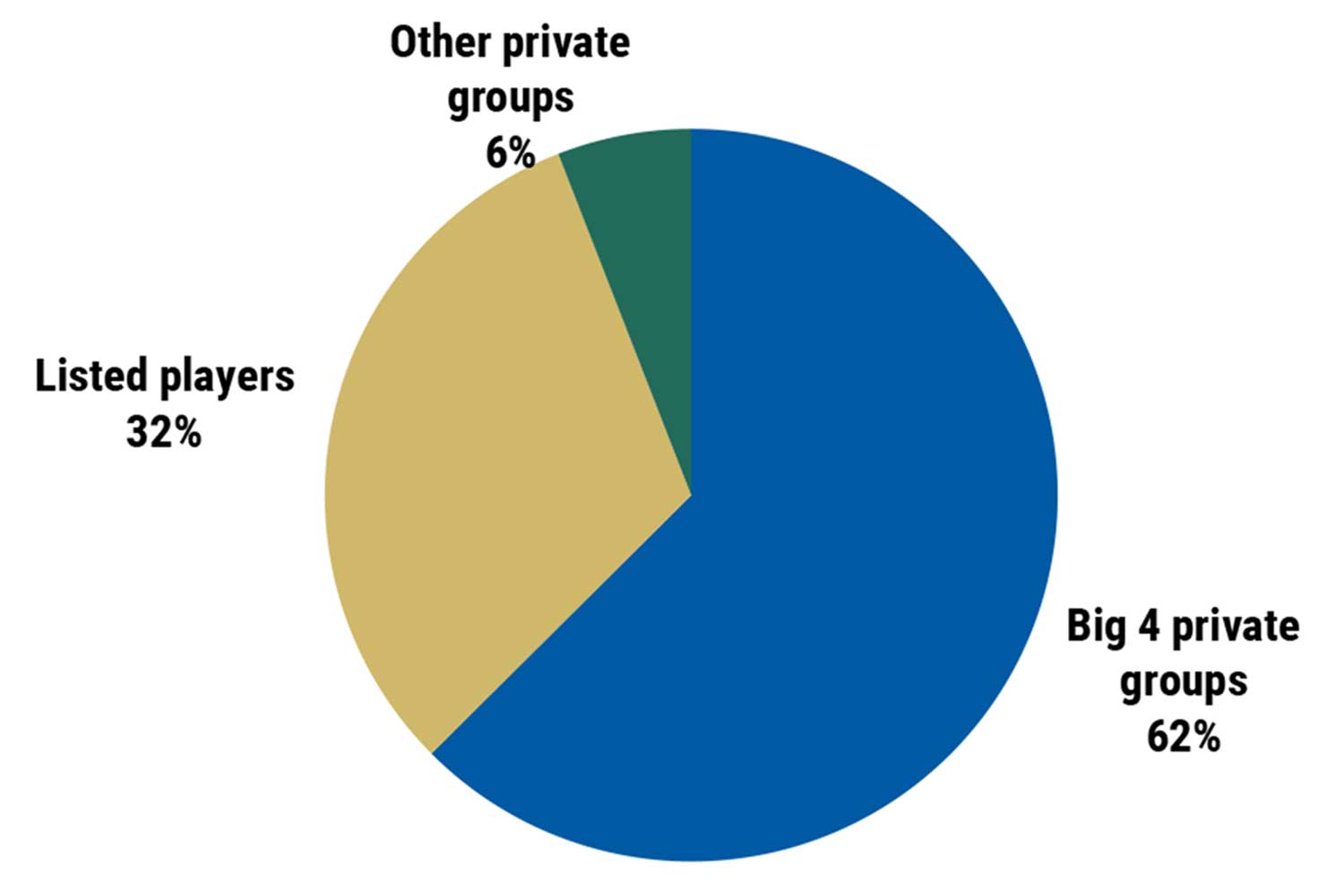

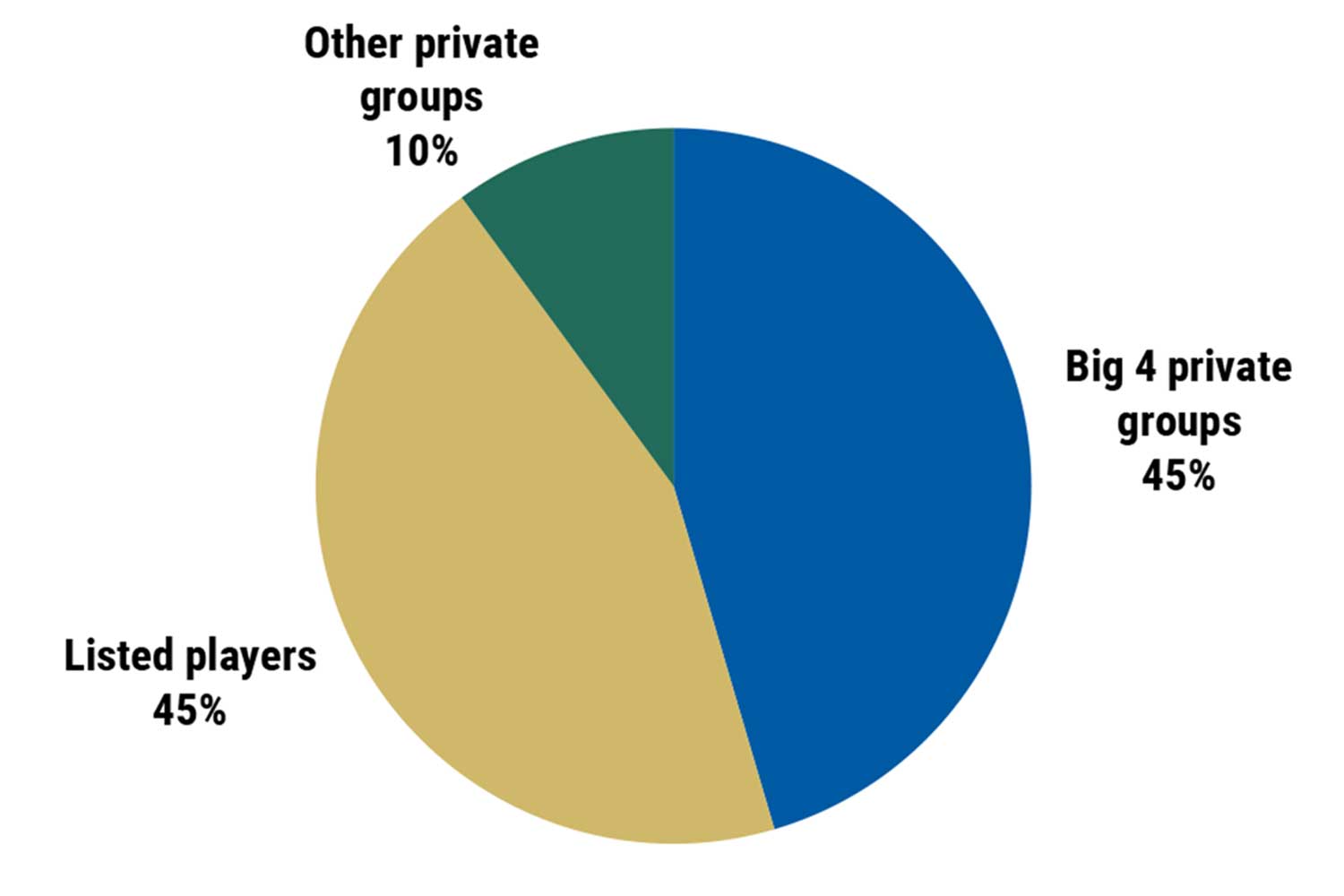

As in prior years, the leading privately owned brands—Rolex, Patek Philippe, Audemars Piguet and Richard Mille—continued to gain market shares. The luxury watch market stands apart from all other luxury segments where listed groups and brands lead their respective product categories.

Amongst listed companies, the performance of Hermès, Vacheron Constantin (a subsidiary of Richemont) and the Swatch brand (a subsidiary of the Swatch Group) was noteworthy (with the latter growing +63% after a +90% year-over-year gain in 2022, making it the fastest-growing Swiss watch brand from our “top 50” in 2023 for the second consecutive year.

And losers in 2023

After staggering growth of its top and bottom line since its takeover by private equity in 2017, Breitling’s conquest of the premium segment has stalled for the time being. The brand has barely achieved growth in 2023 with only +1% sales growth and even a minus for the volumes (-4%). But the peers (apart from Omega achieving a remarkable +4%) had an even worse year, with TAG Heuer declining by -7% and Tudor -4% after years of unabated growth.

Longines (Swatch Group) at -6% is still suffering from a weak Chinese market on which it’s overdependent, and IWC at -13% is losing momentum because of misaligned price positioning.

Swatch Group lost around 70 basis points of market share (to 19.4%) in 2023, we estimate, despite the strong performance of Swatch, Tissot and Omega. It remains narrowly ahead of Richemont (18.7%) in second place and is losing market shares mostly among its luxury brands, with the exception of Harry Winston.

Versus 2019, the cumulative market share loss is around 670 basis points, making the Swatch Group the main market share donor in the industry. The group’s performance last year was negatively impacted by a number of cyclical (slower than expected restart of the Chinese market) and structural factors (namely, underperformance of the luxury pool brands, mainly Breguet, Blancpain and Jaquet Droz). But also, there is a concerning decline at the group’s second largest brand, Longines due to its overdependence on the Chinese market.

Other listed groups: a mixed performance. We estimate that LVMH’s market share declined losing -68 basis points at 5.8%, down -191 basis points since 2019.

Hermès’ sales posted a solid growth at +11% in CHF (+23% in € at constant rates) and gained two ranks to become #16, gaining +7.3 basis points in market shares.

The year of independent brands

I would define an independent brand as one that has no affiliation to a luxury group and that is neither listed nor institutionalized. Given these criteria, the brands can prove very diverse both in terms of sales and market positioning.

Brands such as Richard Mille, Girard Perregaux or Ulysse Nardin wouldn’t be considered independent given their institutionalized status – this is in addition to the fact that for some they are totally or partially controlled by institutional or private investors. FP Journe is in between, as Chanel controls 20% of the brand’s equity, but the FPJ Maison kept the independent’s spirit.

Last year has seen a tremendous growth for such brands and for the first time since we started our ranking, we are seeing three independent brands integrating the top 50 with FP Journe ranked #37 (CHF 98 million), H. Moser & Cie #38 (CHF 93 million) and Greubel Forsey #49 (CHF 50 million in sales).

Even though the economic importance of the aggregated sales of those ~40 brands is rather anecdotical with less ~2% of the total turnover of the Swiss watch industry, their creative initiatives have had an impact on the institutional brands. Wealthy watch collectors are always eager to discover new brands, new stories, and rare watches. They are the buyers of watches capable of buying more than one watch every year at a price point above CHF 50k.

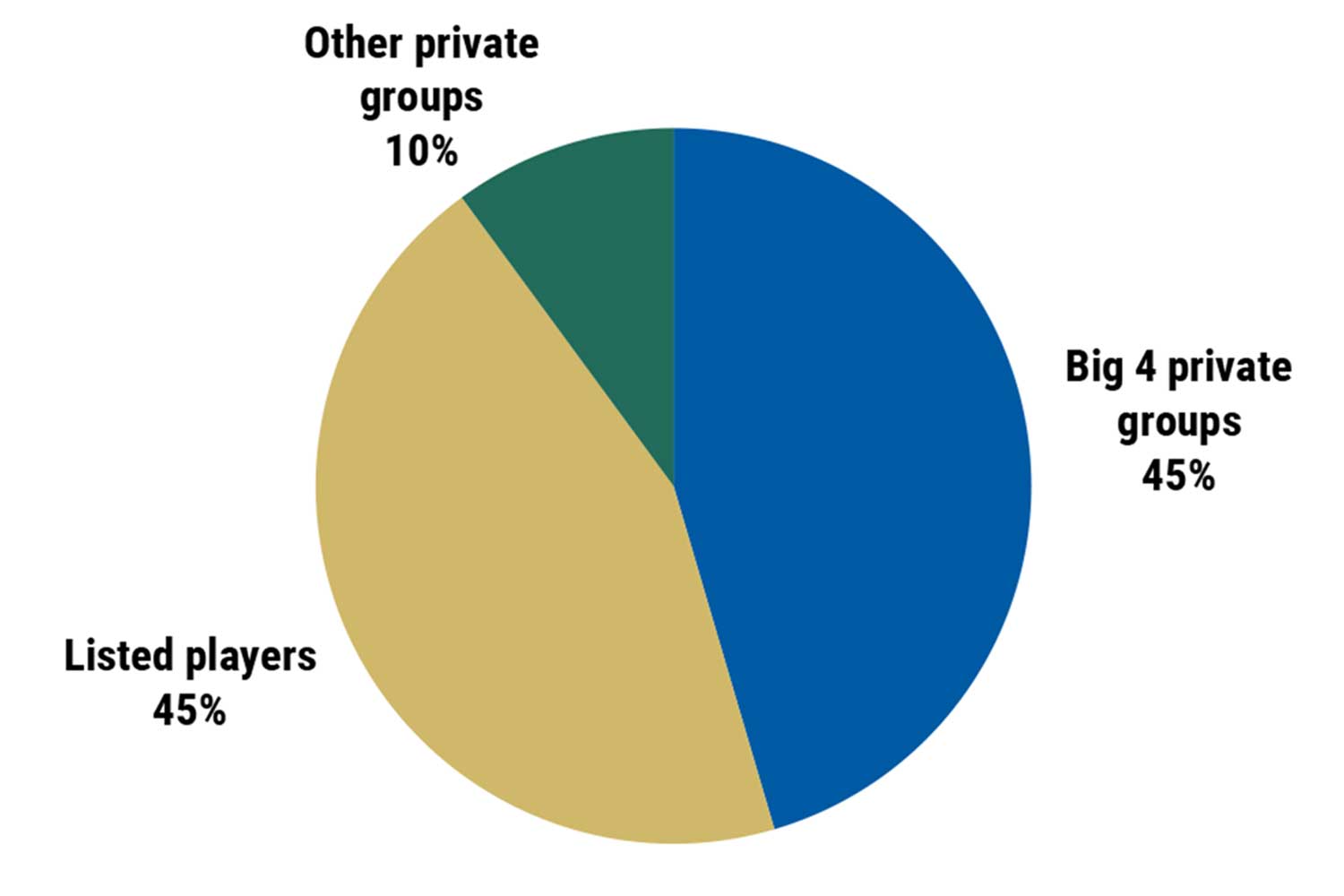

Swiss watch profit pool 2023

Source : LuxeConsult, Morgan Stanley Research estimates. Note: this chart cannot be reproduced without Morgan Stanley’s express authorization

Growing faster on the topline allows brands to capture more margin: this is the magic virtuous circle of capturing additional market shares and becoming more profitable. The “Big 4” are not only continuously increasing their market shares (see above), but also becoming increasingly profitable. The revenue pool shows a 45% stake taken by the leading brands which translates into a staggering 63% share of the industry’s profit pool.

Hermès has shown its peers which strategy needs to be applied to become successful as a luxury brand in the watch industry. The brand needs to align each product category with the overall brand positioning, unless it considers some of them to be aspirational products, such as perfume. Hermès then decided to shift gears and moved into mechanical watches and substantially increased the average selling price. Hermès has shown an impressive growth thanks to this premiumisation strategy which included also shifting sales from mainly wholesale to its own retail (90% in 2023).

It is noteworthy to mention that rival

Louis Vuitton is taking the same path, by massively phasing out the entry level, mainly quartz and entry-level mechanical movements and pushing manufactured movements at a much higher price level. The

launch of the new Tambour at CHF 19,000 retail price with a three-hand watch shows that the brand ambitions to become a collector’s watch. Due to the shift of strategy the brand remained flattish on sales last year, but the first results are showing excellent sell-out rates in the Louis Vuitton stores (100% at directly operated stores).