Castling The King: Rolex is not just about sports watches.

Rolex’s tendency to keep its distance from the rest of the watch industry is sometimes perceived as arrogance by other brands, but it’s certainly part of the brand’s DNA. The brand is an institution and when its leadership is needed to foster an industry-wide project, such as

Watches and Wonders in Geneva,

Rolex takes a stance.

By far the number one in the Swiss watch industry with estimated sales* of CHF 9.3B in 2022, which translates to CHF 13.95B in retail value, Rolex is the reference for any other watch brand. Despite being the untouched — and maybe untouchable — market leader, Rolex is investing a lot of money and energy to ensure its supremacy by establishing standards of quality and precision. Product excellence was one of the founding values of the Rolex brand by its founder

Hans Wilsdorf who was targeting the front stage of technical innovation and precision in the Swiss watch industry.

Two brands with two distinct missions to fulfil

Most of today’s buyers are too young to remember, but Rolex was not a luxury brand from its inception. I, on the other hand, am actually old enough to remember that when I was 5, my parents decided to move to Bienne — the small Swiss town where Rolex is still manufacturing its movements, and where its big rival, Omega, has its headquarters. We moved into an apartment where we could see a huge factory with a sign that says “Rolex”. Guess what? My parents didn’t know what Rolex was. At the beginning of the 1970s, the brand had a positioning like Longines today — mid-range or accessible luxury, however you want to look at it.

The Bienne manufacture is one of four Rolex manufacturing sites

With the

Quartz Crisis (1970-1983) and the pressure put on most Swiss watch brands, a unique opportunity arose for Rolex to climb the ladder of the brand pyramid of the Swiss watch industry. Even though Rolex also tried the quartz path, that experiment was short-lived with an estimated 100,000

Oysterquartz sold over the course of 25 years (1977-2003), which is nothing compared with the brand’s overall sales (est. 1.2 million units in 2022 alone).

Yet Rolex was one of the very few Swiss watch brands that never lost faith in mechanical movements. Even though they did decide to experiment with quartz watches, they never quit the path of “real watchmaking”. That said, Rolex continues to keep its manufacturing capacities of ultra-precise quartz movements and, hypothetically, could at any time launch a high-precision quartz Rolex, a

Tudor or… a dedicated third brand. If this happens, it could be another strike from the empire on archrival Swatch Group and Longines, which has a growing fanbase for its V.H.P. (Very High Precision) quartz watches.

Tudor is here to protect Rolex from below

In 1946, Mr. Wilsdorf, who was a marketing wizard far ahead of his time, decided to launch a sister brand with the purpose of offering watches at a more affordable price than Rolex, thus keeping its stringent quality standards. The second purpose — and later the main mission of Tudor — was to protect Rolex from rivals keen to challenge the champion. Notably, Mr. Hayek — the legendary chairman of Swatch Group — adopted the same strategy when he decided to reconquer the watch market starting from the bottom with Swatch, explaining in a Harvard Business Review interview in 1993 that retreating from lower price segments would allow competitors to move up “to the next layer of the cake”.

And that is exactly what Rolex is doing with Tudor and increasingly so. A very smart move was achieving the

METAS Master Chronometer certification for the

Black Bay Ceramic in 2021, which was intended as a strong signal for Rolex’s main rival Omega, that even its “B” brand can compete at a level beyond the entry range. Rolex is keeping its current double chronometer certification (the movements being COSC certified and the watch head is then internally certified), which lacks an official hallmark comparable with the Master Chronometer — but as we said at the beginning: Rolex plays in a league of its own.

On the other hand, Tudor has been driven by changing strategies since its inception. For a time, it has gone away from its useful purpose of offering an attractive entry into the Rolex world, to being relegated to a sleeping beauty during the decades after Mr. Wilsdorf’s death in 1960. For a time, the people at Rolex were — to put it mildly — not very keen to see Tudor next to their brand. This changed completely with the arrival in 2009 of a new CEO Philippe Peverelli at Tudor with the mission to revive and rejuvenate the brand. Supported by

Davide Cerrato as the product director, the pair managed to quickly bring back a positive momentum by launching vintage-inspired models such as the Black Bay collection in 2012.

Tudor's boutiques express a younger, sportier vibe

A lab for new materials and new ways of communication

Rolex’s brand equity is probably one of the strongest in the luxury world and therefore needs to be kept safe. That is where Tudor’s mission starts. Apart from shielding Rolex from competitors trying to move up the cake (this was one of the reasons why it has a logo in the form of a shield), it plays an important role as the de facto testing lab for the group to try new things out. For instance, the use of new materials such as ceramic. Even though Rolex had used it before for its bezel, branded as Cerachrom as far back as 2005, Tudor was the one that made a full-ceramic timepiece.

Tudor Black Bay Ceramic

Tudor is positioned as the more daring younger sibling talking to a younger audience, and launched in 2021 the Black Bay Ceramic, which can be seen both as an experiment with new materials to be potentially used later on by the “A” brand, and an answer to rival Omega’s Dark Side of the Moon.

Tudor Big Block Chronograph Yellow Gold

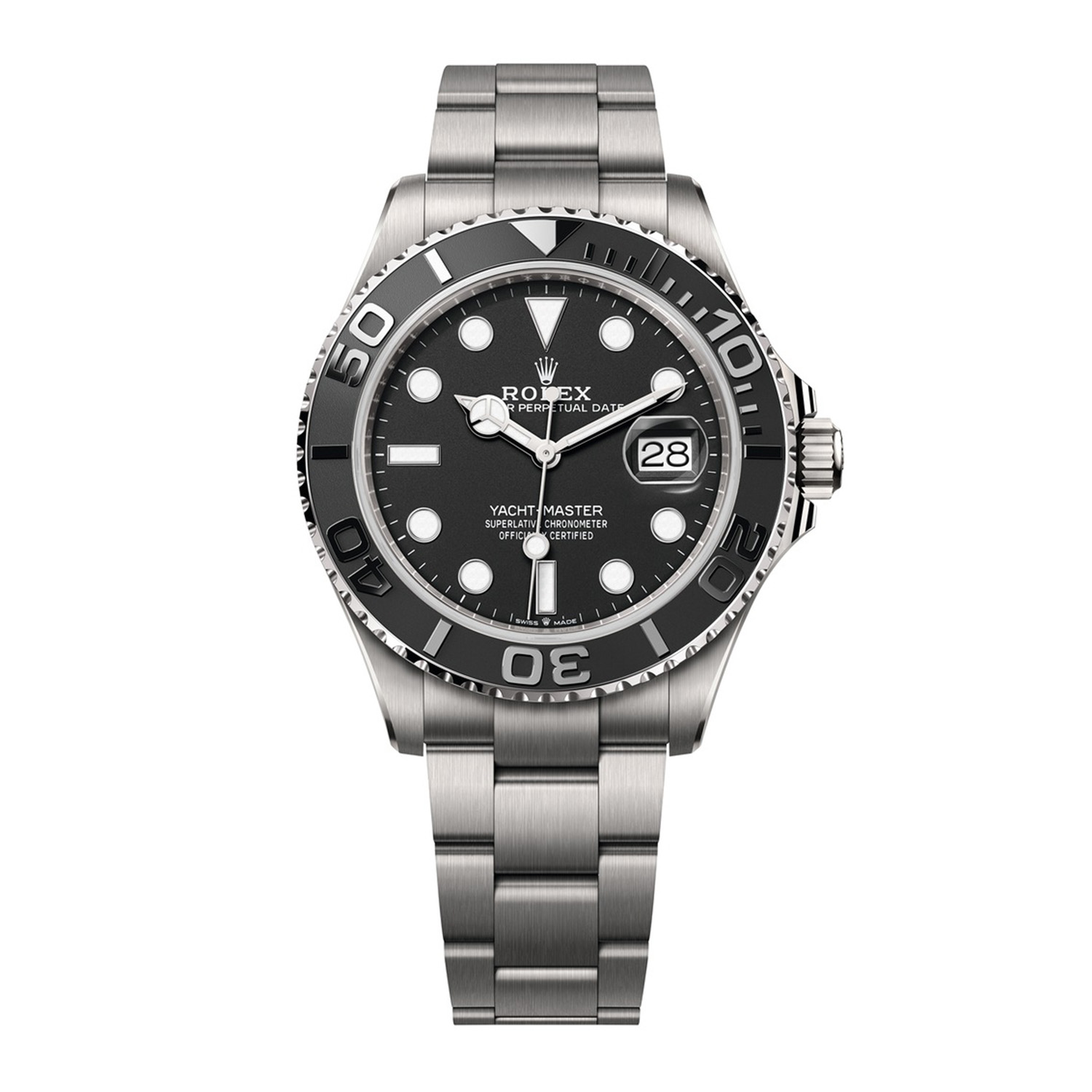

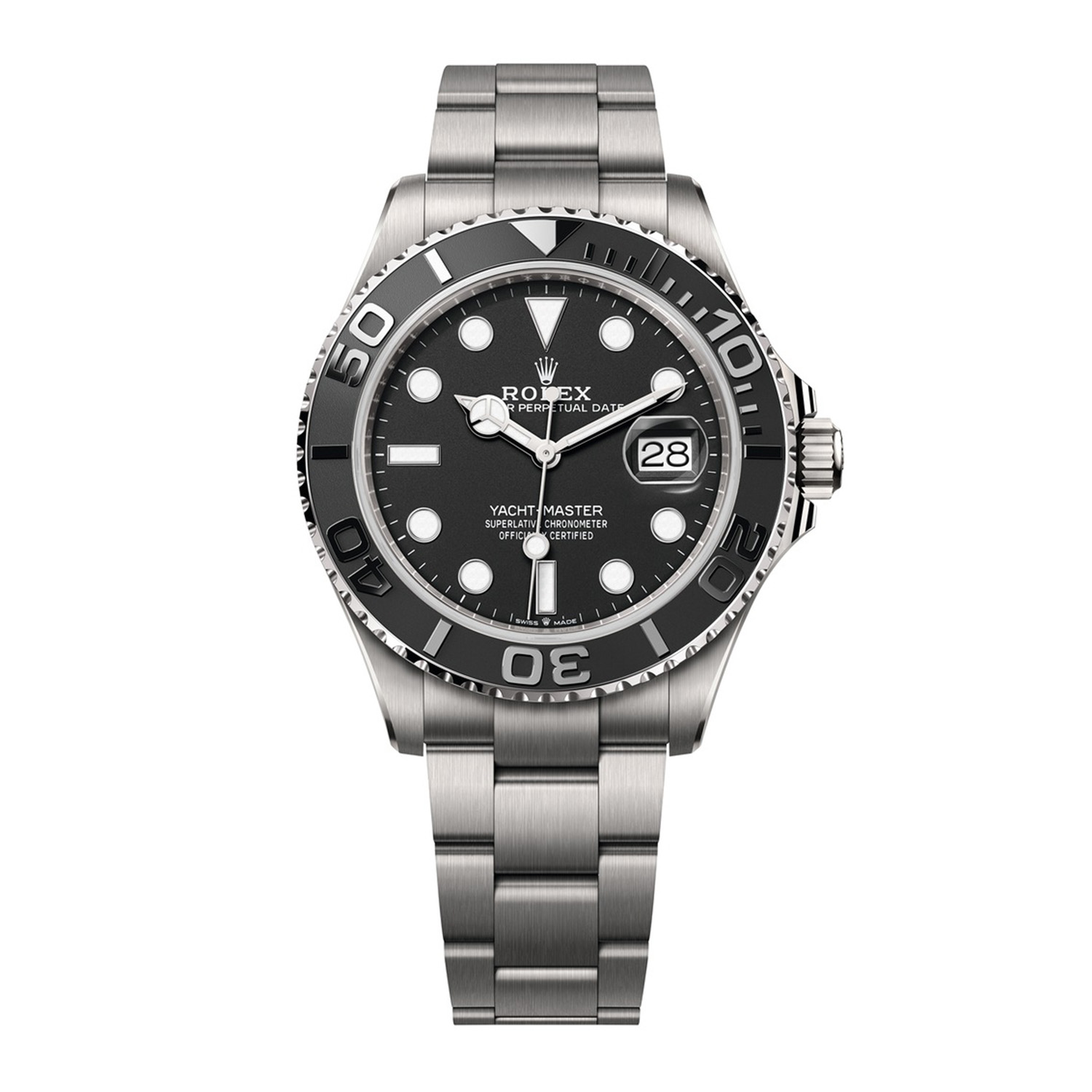

It is the same with titanium. In 2012, Tudor launched its Pelagos dive watch made of titanium, a material that was only used for the first time in 2022 with the Rolex Oyster Perpetual Deepsea challenge. More recently, the Yacht-Master in RLX titanium brought a fresher look into this product family.

Yacht-Master RLX Titanium

Tudor is also building a younger and fresher image of the brand with light and snazzy

campaign videos that are informative but also entertaining — a good way to appeal to Gen Z’s who might hesitate to wear a Rolex because of its institutional image.

Realignment of strategies for both Rolex and Tudor

Despite what certain analysts think, Rolex is not resting on its laurels and the pace of new product launches has tremendously increased since the arrival of Jean-Frédéric Dufour as the new CEO in 2014. Having worked for three decades in various tenures at different watch brands, he immediately identified the growth potential of both brands. In the last decade, Rolex has probably launched more product novelties than it has in the previous three. I remember a time when Rolex aficionados were getting excited by the new version of a Submariner with 1mm increase in case diameter. And, until recently, Rolex hardly communicated about product innovations, considering it part of its mission to continue elevating the brand.

CEO of Rolex, Jean-Frédéric-Dufour

This has totally changed today with the brand introducing whimsical, colorful dials with the “Celebration Dial” Oyster Perpetual and the Day-Date Emoji Puzzle. Both models were launched at Watches and Wonders in March 2023 and certainly prove Rolex’s ambitions to connect to a younger clientele who venerates its product icons such as the Daytona or the Submariner, but also want to see cooler, trendier watches.

Oyster Perpetual Celebration and Day-date Jigsaw

Apart from those “disruptive” designs, Rolex continues improving on small details that make the whole difference. Here are my observations so far.

Focused product management

We are seeing at Rolex a very focused product strategy with a very disciplined way of managing a product collection. The total number of SKU’s is kept at a constant 450 references, which is comparable with Omega, but Rolex’s sales are almost four-fold those of its rival. For every new product launched, there is at least one existing reference being discontinued. This keeps — and even improves — the legibility of the overall product collection.

Increased value proposition

In the last few years, the Rolex product collection has been enhanced with more Rolesium, precious-metal and gem-set watches, which translates to an ever-increasing average retail price which grew by 15% in 5 years* to CHF 11,600. This trend will accelerate in the coming years because the sales mix will be shifting toward higher-priced watches, as indicated by the recent product launches, for example, a new Daytona with a sapphire exhibition caseback — a first for the Oyster Perpetual product line — and a platinum case to highlight that product innovation is coming from the top. The introduction of new Rolesor variations of the GMT-Master II is also a clear sign that the product offering is going up the ladder.

Rolex Oyster Perpetual Deepsea Challange

Luxury rather than sports chic

Far from leaving sports watches behind, Rolex is elevating the game by refining its base designs and offering high-end versions of its bestselling watches. By trying to keep a sound balance between the “bread-and-butter” steel-on-steel watches and more refined variations, the brand avoids getting caught in the dilemma of having to constantly increase the volumes. Having sold an estimated 1.2 million watches last year — which makes it by far the biggest luxury watch brand and the number four Swiss watch exporter by volume, behind entry- and mid-level brands such as Swatch, Tissot and Longines — Rolex is still having a hard time coping with demand.

The long waiting lists on the primary market (six years for a Rolex Daytona) or hefty premiums — up to more than 100% vs. MSRP — for the fast track on the secondary market, are the best indicators of this strong demand. Even though the secondary market has cooled down substantially since March 2022 (e.g. the price of a Daytona came down from CHF 50,000 to CHF 28,000), the overdemand is still tremendous (the Daytona retails for CHF 14,300).

The whole dynamic of moving the brand upward doesn’t take the grip from Rolex and its sound business principles, so you can sense that shifting the two brands up the brand pyramid is done very cautiously. The space left by Rolex when climbing the brand pyramid is immediately covered by Tudor. This synchronization represents certainly a permanent challenge and a threat for the challengers in the first place. Omega, naturally, but also Breitling and TAG Heuer. These brands must constantly adapt their own strategy by launching counter product offensives.

Rolex the sleeping giant has regained a strong momentum and taken back its role of product innovator — but not the loud and disruptive ones — that stems from its DNA.

Tudor reviving icons with vintage-inspired designs

Tudor has experienced a strong revival through vintage-inspired timepieces such as the Black Bay, which made a big splash with each new variation presented in the last few years. It is very interesting to see that the recipes used by Rolex are also applied to Tudor with a compelling logic, such as having a product territory for each family. Diving for the Pelagos, the Black Bay in cross sports, etc. Its structure is, however, questionable with a rather mixed bag within the collection apart from the aforementioned classics which rely strongly on vintage design.

Why the Clair de Rose, which could go unnoticed rebranded under another name? The same goes for the Glamour product family. Apart from probably selling in high quantities to Chinese consumers who have for a long time represented its major market, they rather dilute the collection’s legibility. The Black Bay 31, 36, 39 and 41mm variations, too, look like intruders in its product family.

Rolex Pelagos Titanium

Once it had been decided to reboot Tudor, the brand’s distribution was diversified and could still be viewed in some markets as a new brand. In the US, the brand was relaunched in 2013 after having quit that market in 1996.

The distribution strategy has now shifted to move as a team — not twins, but siblings — and this requires that when a new Rolex boutique opens, a Tudor boutique is also being installed next to it (Rolex doesn’t operate any retail activity, apart from one boutique in Geneva). This is a major shift from its previous attitude of having the two brands clearly separated through distinctive sales channels.

Still room for improvement

On the whole, Tudor’s branding feels a little bit less inspired than Rolex’s, with its conventional approach of using brand ambassadors and a tagline “Born To Dare” which fulfills its purpose of a cool hashtag on any social media, but lacks coherence with the rest of the branding. One could make the argument that a tagline like that doesn’t immediately gel with products such as the vintage-inspired Black Bay. From a brand consistency point of view, if we were to make a comparison with Breitling’s brand pillars comprising purpose-dedicated squads and their respective territories, Tudor’s storytelling needs more coherence, which shouldn’t be a big challenge. After all, the epitome of branding coherence is Rolex! There, everything is perfectly aligned and anyone looking at the brand doesn’t need a PhD in marketing to immediately understand what the brand is about: excellence in manufacturing, and hence precision.

Last but not least, when comparing the number of SKU’s between the two, Tudor’s is around 500, while its sister brand is making 16 times more sales with 450…. There is still room to focus Tudor’s product offering on its strengths.

A unique market positioning and a bright future

Meanwhile, Rolex has a unique competitive positioning with almost one-third market share (29% for Rolex and 2% for Tudor*) of the whole Swiss watch industry. To appreciate that figure, we could add that 96% of the worldwide luxury watch market** (watches with a retail price tag above CHF 1,200) is controlled by Swiss-made or Swiss-owned brands. Even more compelling is the fact that Rolex owns an estimated 40% market share in the USA, which is the number one market for Swiss watches at the moment.

There is no other luxury brand in any other segments of the luxury industry that is as dominant as Rolex in their respective markets. Another comparison that we can draw is with a multi-product brand such as Gucci achieving €10.4 billion, which is marginally more than Rolex’s CHF 9.3 billion, but less if we take into account the fact that Rolex is retailing only through third parties (with the one exception mentioned above). In fact, Morgan Stanley estimates* that Rolex has created CHF 13.95 billion in retail value in 2022 or put the other way round, it doesn’t yet capture a retail margin of CHF 4,65B. Now let’s imagine that Rolex decides to integrate their retail network entirely or partially. What would it mean in terms of profitability and the consequences on the worldwide retail structure?

At Tudor, the potential margin to capture would be CHF 256 million and that would easily justify going into brand-owned retailing. Even though Rolex has decided — at least for the time being — not to capture the retail margin, it is quite easy to estimate that its profitability as a mono-product brand must be staggering, and even more so when you take into account the fact the production is almost fully integrated.

Rolex still has tremendous potential with a market getting more and more polarized and premiumized. The brand is increasingly applying the same rules as any other luxury brand with regular price increases due to its pricing power, and better brand visibility through a broad range of sponsorships across sports and the arts. Rolex is also very good at becoming the exclusive partner in one domain — for example, Formula 1, tennis or golf — by sponsoring all the main events worldwide.

Once the brand has established its superiority, the sexiness, social status and foremost brand equity will keep growing in a virtuous circle. Rolex is delivering a masterclass in proving that a sports-grounded brand can be luxury. When others struggle to establish a bond between their brand and their sponsorship activities, Rolex has achieved just that since the founding of the brand. Sports-chic and increasingly luxurious Rolex will pursue its journey for glory.

*Estimates published in Morgan Stanley’s annual report on the Swiss watch industry market shares “Sixth Annual Swiss Watcher”, in collaboration with LuxeConsult

** Estimates by LuxeConsult in its exclusive report on “The secondary watch market, pre-owned, pre-loved and gray market timepieces”