The Ultimate Winner: How Rolex Shined Through 2020

By the end of 2020, the decline in exports had started to slow down, thanks to China — the ultimate saviour for the Swiss. Over the last six months, Chinese consumers have created a surge in sales for luxury watches in the mainland with a strong demand for brands like Rolex, Omega, Cartier, Patek Philippe and Audemars Piguet.

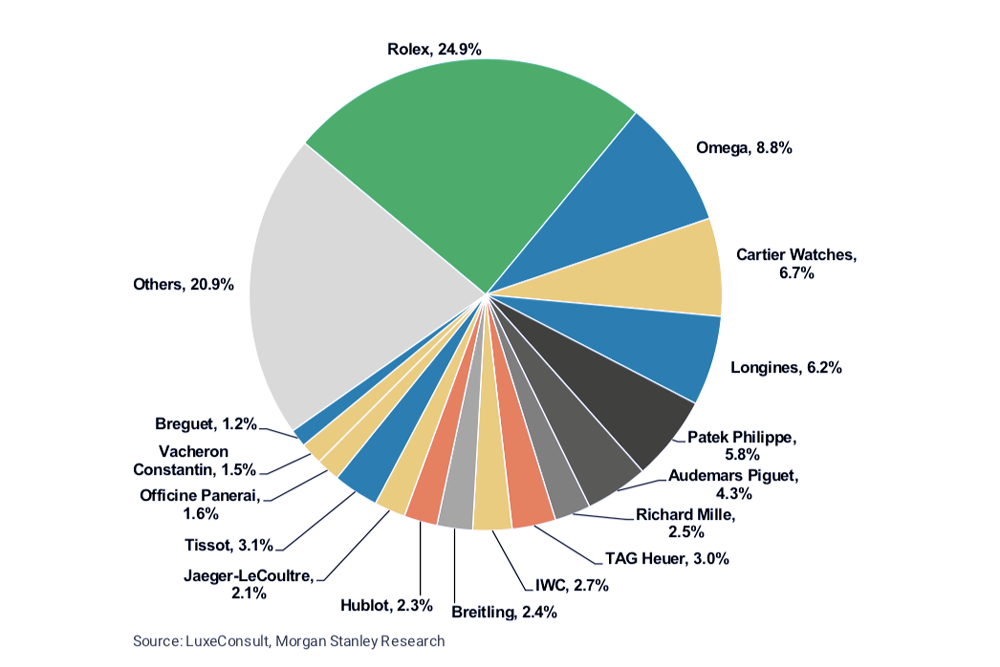

With a 26.8 percent market share Rolex SA has trumped Swatch group (at 25.2 percent) to become the world’s largest watchmaking company.

The Crowning Glory

While a large number of watch brands were slammed by the pandemic and the subsequent economic instability, the demand for privately-owned top brands like Rolex and Patek Philippe didn’t nosedive as badly as expected. According to the latest report on the Swiss watch market brought out by Morgan Stanley in collaboration with LuxeConsult, 2020 turned out to be a golden year for the Rolex group, or the Rolex SA that also owns Tudor.

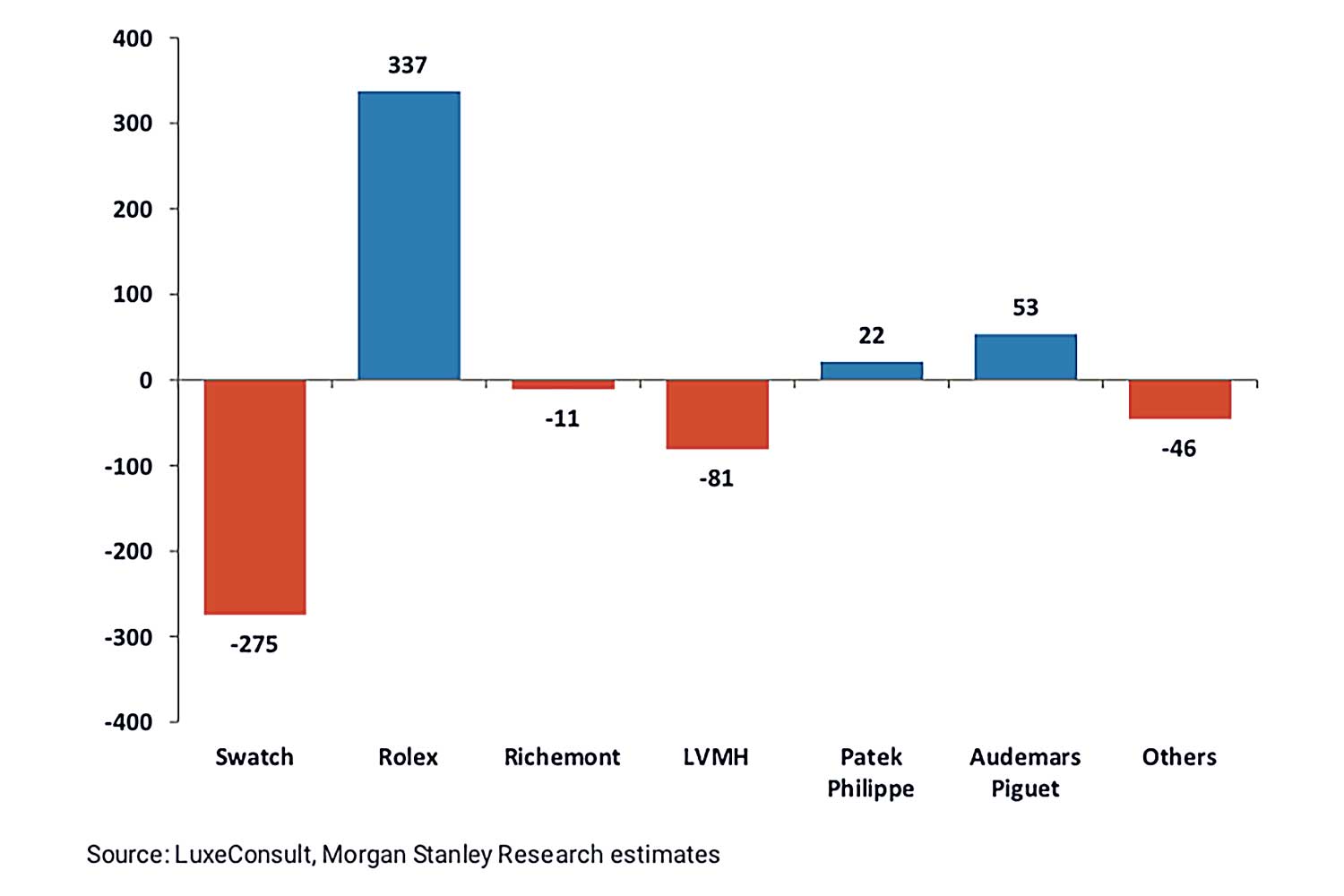

Though Rolex has been the most sold Swiss watch brand in terms of value for a number of years now, it became the largest watch group in Switzerland for the first time ever in 2020. With a 26.8 percent market share Rolex SA has trumped Swatch group (at 25.2 percent) to become the world’s largest watchmaking company. Richemont, where Cartier accounts for 40 percent of watch sales, has a market share of 18.2 percent, followed by LVMH at 7.1 percent.

Estimate market share by brand in 2020 (retail value)

Estimate change in market share in 2020 by Group

The relentless demand for Rolex’s key models like Paul Newman's Daytona in the secondary market have created an unmatched desirability for the brand.

The relentless demand for the brand’s key models like the GMT, Submariner, Explorer or the Daytona in the primary and secondary markets have created a desirability for Rolex that stands unmatched. Yet last year, Rolex reduced its production by almost 20 percent due to the pandemic-enforced shutdown in Switzerland.

Rolex released the new Oyster Perpetual Sky-Dweller (left) and the Datejust 31 in 2020.

The Rise of Tudor

Over the last 10 years, Tudor has significantly come out of the shadow of its mighty cousin Rolex to stand on its own as one of the most desirable watch brands among youngsters. Helped by a dose of celebrity endorsement by the likes of David Beckham and Lady Gaga, Tudor has been building up on its enduring style with a range of watches that are much more easily available and affordable than Rolex.

With the help of celebrity endorsements by the likes of Lady Gaga and David Beckham, Tudor has been building up on its enduring style with a range of watches

In 2020, Tudor was one of the few watch brands that managed to scale up sales despite the downturn.

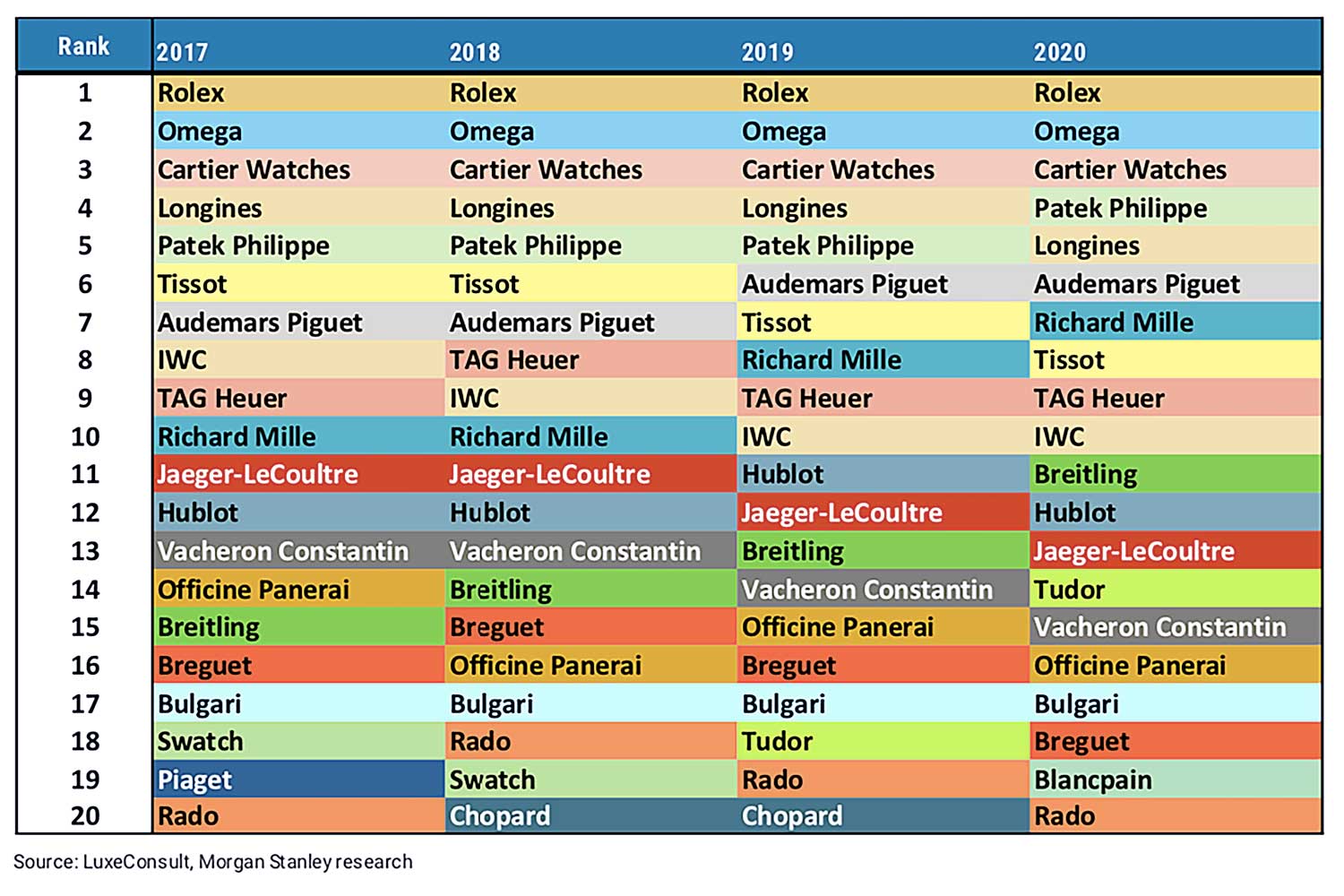

Star Performers 2020

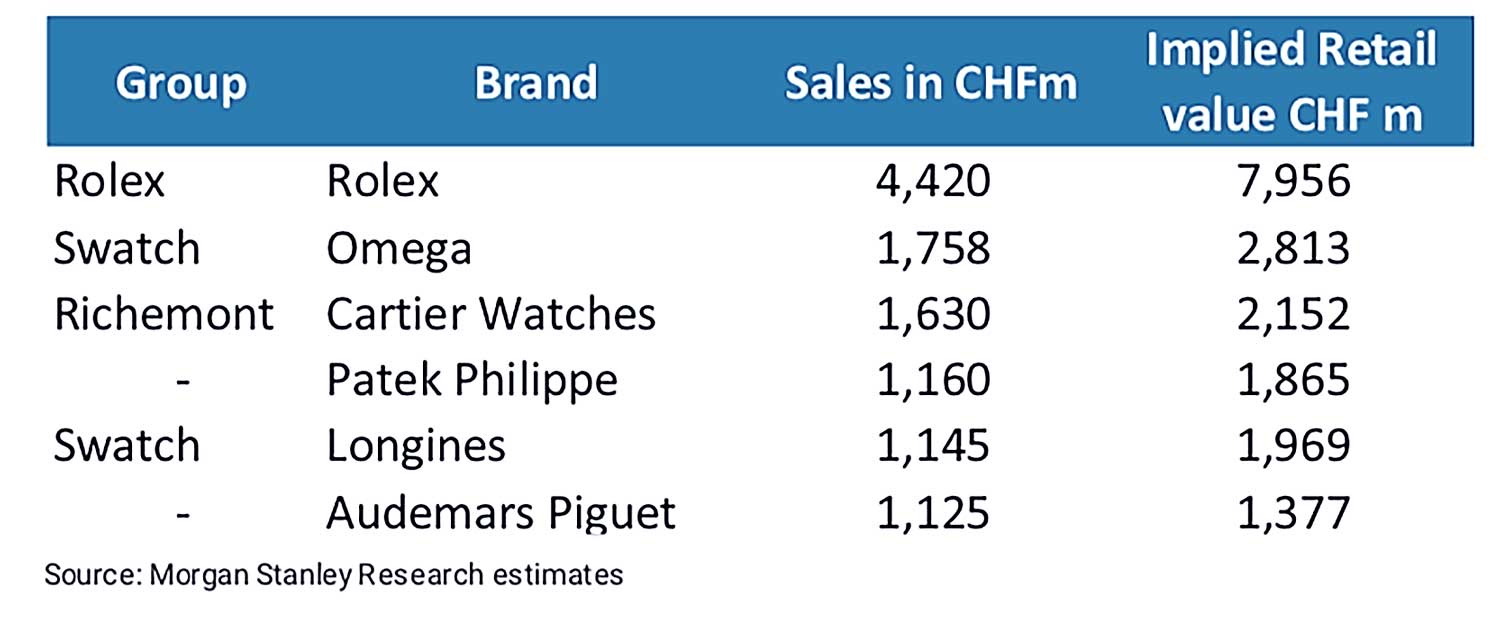

Besides Rolex, the key watch brands that promise to bring the industry back on its feet this year are Omega, Cartier, Longines, Patek Philippe and Audemars Piguet. While the overall industry suffered a 21 percent decline in value and 33 per cent in volume in 2020, these brands recorded an impressive performance in an otherwise lacklustre year.

The top 20 Swiss watch brands by sales since 2017 (Source: Morgan Stanley)

The billionaire’s club

Omega

As per the Morgan Stanley report, Omega with its estimated sales of CHF 1,758m in 2020, ranked second in terms of the total turnover among the top five watch brands in Switzerland. Just 38 percent lower than Rolex, Omega sold approximately 500,000 watches last year. “Given Omega’s lower average price per unit (CHF 5,620) in 2020, the gap in terms of market share is relatively wide. We estimate Omega’s share at about 8.8 percent in 2020 vs. 24.8 percent for the Rolex brand,” states the report. The brand was also able to increase direct e-commerce penetration quite markedly — from 6 percent to 12 percent — last year.

Cartier

Over the last four years, Cartier has been wooing watch connoisseurs with the most amazing modern interpretations of its icons like the Tank Cintrée, theAsymétrique, Santos de Cartier, Crash and the Santos-Dumont. The credit for Cartier’s recent rise as one of the top three covetable brands in the world goes to its dynamic CEO Cyrille Vigneron, who has been focussing on bringing back the most elegant vintage designs in special editions for the discerning.

Only six of the 350 brands in Switzerland posted a turnover exceeding CHF 1billion last year and Cartier was one of them.

Longines

While Longines’ average retail unit price is relatively low (at CHF 1,350) as compared to the top three brands, it sold an estimated 1.5m units in 2020, allowing it to capture 6.2 percent market share in the industry. Longines launched a few vintage-inspired watches in 2019 and 2020, which generated good traction.

Patek Philippe

“2020 was not our best year, but it was okay,” said Patek Philippe president Thierry Stern in a recent interview with Swiss newspaper Neue Zürcher Zeitung. “At the end of the year, we were a good 20 percent down in terms of sales, but that’s not a problem because as a long-standing family business, you’re prepared for such things and have reserves,” he said.

As per Patek Philippe’s president Thierry Stern, the company sales were down by 20 percent last year.

Audemars Piguet

With a reported turnover of CHF 1,125m last year (down only by 9 percent from 2019), Audemars Piguet was one of the best performing watch brands from a top line perspective. According to Müller, the brand’s success can be explained by its coherent product and branding strategy. “The number of doors selling AP watches have been strongly reduced in recent years and either integrated in brand owned mono-brand boutiques or joint-ventures with leading retailers. AP’s advantage is also its size, which makes it possible to shift production and distribution priorities quickly and to adapt to the market,” he says.

With a reported turnover of CHF 1,125m last year (down only by 9 percent from 2019), Audemars Piguet was one of the best performing watch brands from a top line perspective.