News

The Revolution Success Index

News

The Revolution Success Index

Based on the 2023 Morgan Stanley × LuxeConsult report, these are the 20 most successful individuals, groups and families in the luxury watchmaking industry. While a key part of the metric used to determine their success has to do with their accumulated wealth, beyond that, each of these individuals, groups or families has made a major contribution to the industry. Indeed, one could say that the Swiss watch industry is built on the shoulders of their leadership, innovation and brilliance.

The simple definition for success is the accomplishment of an aim or a purpose. What unites all of the brands, families, groups and individuals featured in these pages is that they have had the audacity to dream big and the temerity, resilience, courage and capability to execute their goals.

One example is Jean Arnault who just two years ago had set out to completely change the world’s perception of Louis Vuitton watches and, through his bold relaunch of the Tambour and championing of independent watchmaking, has completely transformed the way we see Louis Vuitton today. As another example, it would be fair to say that this is the year we truly see the brilliance of Jean-Frédéric Dufour’s leadership at Rolex: first with the acquisition of Bucherer and Rolex’s first entry into retail; second, through the global elevation of Rolex watches in terms of quality, beauty and design; third, in the proliferation of the Rolex Certifed Pre-Owned (CPO) program; and fourth, in his elevation of Tudor to be the market leader in the luxury tool watch category.

Even though François-Henry Bennahmias is leaving Audemars Piguet, his legacy in transforming this brand from a CHF 630 million a year business in 2012, to a CHF 2.01 billion a year juggernaut (with a 2023 estimate of CHF 2.4 billion) is extraordinary. And though he works decidedly behind the scenes, Omega’s Raynald Aeschlimann, who is growing in his job scope at the Swatch Group, continues to be one of the most impressive leaders on the market.

Richemont Group’s three brilliant CEOs, Cyrille Vigneron of Cartier, Nicolas Bos of Van Cleef & Arpels and Louis Ferla of Vacheron Constantin (his brand is estimated to pass the CHF 1 billion mark this year), bring dynamism to their brands in a massive way. Among the family-run watch brands, Richard Mille has now firmly assured his succession plan with his very capable and incredibly dedicated son Alexandre Mille in place as brand director.

Patek Philippe’s Thierry Stern continues to bring his brand from strength to strength even while grooming the next generation of Stern leadership. Finally, we also see a generational change beginning in Chopard with Caroline-Marie now working on product development with her father Karl-Friedrich, and her brother Karl-Fritz who is already responsible for the brand’s successful Alpine Eagle model is not long off from joining her.

What are the key takeaways over the last decade? The growth of the watch industry has been mainly driven by the high-end brands.

The polarization of the industry with just a few brands producing high-value watches and fostered by strong brand equity, such as Rolex, Patek Philippe, Audemars Piguet and Richard Mille, is reflecting the overall trend of the luxury industry, which is moving upwards in all product categories. One very distinctive difference of the watch industry compared with all other luxury product categories is that the privately owned brands are performing far better than the ones owned by listed luxury groups, albeit with one remarkable exception which is Hermès, even though the brand shares more characteristics of a family-owned company than a listed company with only 32.3 percent free float traded shares, but foremost a long-term view on the business.

With this ranking, we are aiming to establish a top 20 success index of the owners of watch brands. The watch world being a very secretive industry, we base our estimates on trusted sources such as the yearly Morgan Stanley report on the luxury watch industry that I’m co-writing.

The estimated wealth of the following 20 individuals, families, trusts, private or listed companies are based on their overall assets. Methodology is based on the estimated value of the market price — in the case of a listed brand or group — or the estimated value, which is a multiple of the estimated sales and EBITDA (the operational gross margin before taxes, depreciations and amortizations) on which I added the brand equity/goodwill.

I also indicated the estimated retail market share of the Swiss-made or Swiss-owned watch industry to give an idea of how important the watch business is for each person or institution mentioned. These values (in CHF) were taken from the annual Morgan Stanley × LuxeConsult report last published in March 2023 based on the estimated 2022 sales.

#20 Patrick Pruniaux

Brand: Sowind Group (Ulysse Nardin, Girard-Perregaux)

Brand Net Worth: CHF 65 million

Total Market Share: < 1 percent

Patrick Pruniaux, CEO of Girard-Perregaux

Girard-Perregaux was once upon a time at eye level with brands such as Vacheron Constantin and Breguet when the three of them were competing at the highest echelon of watchmaking. Since then, one brand, Vacheron Constantin, has managed to keep a positive dynamic to grow steadily and will probably integrate the top 10 of the Swiss-made watch brands in a not-too-distant future.

Girard-Perregaux, on the contrary, has experienced a drastic fall of its sales since its owner family sold it to Kering in 2011 and from then on — due to strategic mistakes by the management — a negative dynamic started. Then in 2014, Kering acquired Ulysse Nardin, another mythical name of Swiss watchmaking with a strong heritage linked to marine chronometers, and Patrick Pruniaux became the CEO for both brands.

These are two extraordinary brands with very distinctive DNAs, with one them being positioned as a historical player in fine watchmaking. Girard-Perregaux could rely on its own manufacture with in-house movements.

The manufacture was even selling movements to third parties, such as MB&F or Urwerk, which are household names in independent watchmaking. But due to the lack of a clear market positioning and, despite having created some iconic timepieces such as the Tourbillon with Three Bridges, the WW.TC worldtimer, the Laureato and the beautiful Vintage 1945 watch, it completely lost traction and the brand awareness quickly declined.

Its sister brand Daniel JeanRichard (later JeanRichard) was uselessly absorbing management capacities and not finding its public.

In 2022, Kering finally announced the end of the value destroying watch project and announced the sale of both GP and UN to its management, after having burned an estimated EUR 1.2 billion with the brands’ acquisitions and covering operational losses for years. Having a rich shareholder is sometimes not the best motivator for finding success.

Mr. Pruniaux and his team have, since the completion of the management buyout, done tremendous work at repositioning the two brands with clear and distinctive brand territories. Girard-Perregaux has taken advantage of the trend of sports chic watches with its in-house designed Laureato timepiece, which is unlike other such watches of the time in that it has been powered by an in-house movement right from the beginning.

It remains to be seen in the long run if the current success of this market segment is enough to rebuild the brand’s road to success.

Ulysse Nardin has been rejuvenated with a strong communication based on its links with marine life and chronometer tradition. But its main pillar which might prove to be the strongest one in the long run is its horological know-how — together with a strong manufacture — which has been perfectly demonstrated in the disruptive Freak product family.

Using a silicon escapement today might not be as innovative or disruptive as it was when the Freak was launched more than 20 years ago, but it’s still one of the most intriguing mechanical concepts seen in the watchmaking world for a long time.

A challenging, but promising project to bring two icons of the Swiss watchmaking elite back to their former glory, the rebuilding of Girard-Perregaux and Ulysse Nardin will need a long-term vision which might be better secured with the new owners and especially its CEO, Patrick Pruniaux.

#19 Maximilian Büsser

Brand: MB&F, M.A.D. Gallery

Brand Net Worth: CHF 80 million

Total Market Share: < 1 percent

Maximilian Büsser, CEO of MB&F SA

When Max Büsser explained me the first time what MB&F was about, he lectured me on the fact that he wasn’t launching a brand, but a lab. I must admit that I took it more for arrogance than a brilliant idea.

But that was more than 17 years ago and his first timepiece, the Horological Machine No. 1 (HM1), had not yet been launched. It took me time to understand that Max was serious about reinventing the way a timepiece shows time.

The disruptive part of his concept is that each machine is totally different from the previous one, and is a 3D sculpture showing mechanics with very bold designs taking a lot of inspiration from cars — not from today, but from the golden age of supercars in the 1960s and 1970s when car designers would dare to create spaceships. For instance, the HM5 immediately reminded me of the Lamborghini Miura, which is still in my top 10 of the most beautiful cars ever.

The success of MB&F is very much based on Max’s charisma, but it would be unfair to reduce it to his good looks and intelligence. Max is very literate about watchmaking’s history and knows a thing or two about product design and coherent product concepts, having worked at Jaeger-LeCoultre and Harry Winston where he created the legendary Opus collaborations with independent master watchmakers.

He took that idea over when he created the MB&F concept and started collaborating with other watchmakers; for example, he worked with Kari Voutilainen on a Legacy Machine, which is Büsser’s way of paying tribute to fine watchmaking of the 18th century. And the “F” in the brand’s name is not only about the friends’ storytelling, but about being transparent on who does what.

When I look at all those new brands popping up every other month with a new “Mozart of watchmaking” making the exact same watch as every independent, focusing more on the perfect polishing and engaging angles on the movement than on real innovation, I appreciate MB&F’s true innovative way of creating timepieces. Even though I hadn’t understood how disruptive Max’s approach would become, I was proven right at least on one aspect and that is, MB&F is a brand.

And a fine and successful one employing 45 people and generating sales of more than CHF 40 million this year. However, Max’s impact on modern watchmaking far exceeds the company’s revenue figures.

It can be said that he is as instrumental to contemporary horology as Jean-Claude Biver has been to the previous generation, purely through the force of his personality, intelligence and charisma.

#18 François-Paul Journe

Personal Net Worth: CHF 100m

Total Market Share: <1%

Brand: F.P.Journe

François-Paul Journe, Founder, F.P.Journe

Without a doubt the most talented watchmaker of his generation, François-Paul Journe has not only created a unique product signature, but also foremost a brand. F.P. Journe is one of the very rare so-called independent watchmakers that have understood and managed to create a brand which will survive its namesake creator. And it is a fine watch brand with a very distinctive product signature paying tribute to fine French watchmaking of the 18th century.

His timepieces are fitting homages to the finest and most disruptive watchmakers of the golden age of fine watchmaking, such as Breguet, Berthoud and Leroy, amongst others. Someone who is literate about watchmaking history would have no problems understanding what Mr. Journe is doing when he works on the Résonance or his Centigraphe, which is an astonishing piece of micromechanics.

But the man is also capable of making his own electromechanical watches as seen in the Elégante collection dedicated to women. The concept is the perfect combination of the best of the mechanical world and quartz technology.

The maison F.P. Journe also owns its own manufacturing capacities producing its movements, cases and dials.

The brand relies on a very selective retail network and owns 11 mono-brand stores around the world. But what impresses me most is the sheer devotion of his clients who adore the man as if he was the head of a cult.

Another detail — which is in fact important — is the decision not to print or engrave the word “Swiss,” because Mr. Journe considers the Swiss-made hallmark not stringent enough for his creations. Instead, you’ll find an engraving on the movement saying “Geneva Made.”

And the “Invenit et Fecit” (invented and made) tagline of the brand is a manifest of the DNA based on creating unseen concepts.

Last but not least, the fact that Chanel — a major player in the luxury industry — has taken a 20 percent equity stake in F.P. Journe is a huge compliment for a brand created only 30 years ago with the first wristwatches launched in 1999. And I would like to finish with an anecdote from Baselworld that year where Mr. Journe attended with his business partner to meet some collectors.

One evening, the whole team of the brand I was working at was celebrating another record day with eight-figure total orders and we were wondering who that man at the back of the bar was. One colleague told us, “His name is Journe and someone told me that he will be the star of artisan watchmaking.”

But when he followed up that the guy was making less than 20 watches a year, we had a good laugh. Such is life.

#17 The Bernheim family

Net Worth: CHF 100m

Total Market Share: <1%

Brand: Raymond Weil

Elie Bernheim, CEO of Raymond Weil

Existing competitors, such as Tissot or Longines and new ones such as, Frédérique Constant, have made life hard for this brand competing with such heavy weights. The third generation of the owner family is still involved in the management of the brand but does not show a tremendous passion to reboost Raymond Weil to the path of growth.

With the recent acknowledgement by the GPHG however, for the Millésime Automatic Small Seconds which was awarded the Challenge Watch Prize by the Jury, Raymond Weil appears to be making a timely return to the forefront.

#16 Jean-Claude Biver

Brand: Biver

Personal Net Worth: CHF 150 million

Total Market Share: <1%

Pierre Biver (left), Co-Founder and CEO of JC Biver, with his father, Jean-Claude Biver (right).

Like any artist, Jean-Claude Biver dreams of dying on stage while performing his last masterpiece, which, in his case is Biver, the watch brand he launched with his son Pierre in 2022. A much beloved larger-than-life character, Biver has mastered three times what others could only dream of achieving once in their lifetimes.

He revived Blancpain, a sleeping beauty in the portfolio of SSIH (the predecessor of the Swatch Group). Biver bought Blancpain with his business partner Jacques Piguet in 1982, cleverly mixing classical watches with a very distinctive design and a reinterpretation of all mechanical complications.

Biver can be considered as one of the watch entrepreneurs that have re-enchanted mechanical watchmaking after the Quartz Crisis, which had all but killed traditional watchmaking. Biver and his partner rolled out fantastic storytelling which was partly based on historical facts relating to its founder, Jehan-Jacques Blancpain, and some “interpretations” of his role in watchmaking history.

In 1992, SMH, the company which had emerged from SSIH and ASUAG, bought back Blancpain and added Frédéric Piguet, the movement manufacture, to its industrial portfolio. Biver and Jacques Piguet cashed in more than CHF 60 million, which made their return on investment for the brand quite incredible having bought it for just CHF 18,000.

Biver the market genius and Piguet the grounded technician were the perfect duo, much like many success stories in the history of watchmaking — Czapek and Philippe, Vacheron and Constantin and many others — and more recently Richard Mille and Dominique Guenat, who associated their talents to make Richard Mille the most extraordinary success story of the last 30 years in watchmaking.

Biver then went on to help revive Omega, the flagship brand of the Swatch Group which had been revived by a team around Mr. Hayek Senior, but was still not at full speed. Biver decided to heavily push on the brand testimonials to capture a maximized attention and decided to go only for the number one in each field; for example Cindy Crawford, as the ultimate supermodel, incarnating the brand’s claim “My Choice.”

Even though it was not Mr. Biver who decided to sign a long-term collaboration with the producers of the James Bond movies, he was the one who brought in the magical equation of 1+1 = 3. This means that investing in sponsoring requires the same amount in promoting it and thus enhances the result.

Many watch brands at that time hadn’t understood that being somewhere associated with an event or a brand ambassador was only fruitful if you were capable of investing the money needed to promote it.

After leaving the Swatch Group, Mr. Biver was contacted by the owner of Hublot, Mr. Carlo Crocco, who had taken the decision to retire from the brand’s daily operations. When Biver got into the game with his longtime lieutenant, Ricardo Guadalupe, who had worked alongside Biver at Blancpain, the brand still had an iconic watch which had been very successful back in the 1980s and 1990s.

Merging rubber with precious metals was a very bold move back then and Biver summarized it with the “Art of Fusion.” But he sensed that the brand also needed a bolder product design to re-boost it and that watch became the Big Bang, which angered some people in the Vallée de Joux who — rightfully — sensed that too much inspiration had been taken from their iconic watch.

In five years from 2004 to 2007, Biver increased Hublot’s sales fivefold which attracted the attention of LVMH who then bought the brand in 2008 for CHF 430 million. Biver cashed in an estimated CHF 86 million and continued to manage the brand until 2014 when he received the mission of bringing TAG Heuer and Zenith back on track.

Biver tried what any successful brand manager does, by applying a recipe which had proven to be magical already three times. He tried to give more visibility to the brands by product placements in movies and brand endorsements by celebrities.

During the four years until 2018, Biver and his teams tried all the recipes, but didn’t really manage to bring either TAG Heuer or Zenith back on the path of growth. To be fair, the expectations towards Zenith are not in line with the brand’s intrinsic potential.

Everyone sees it as one of the legendary names of the Swiss watch industry, besides owning the iconic El Primero movement. TAG Heuer has been at the forefront of modern-day branding but somehow got lost in trying to reinvent mechanical concepts, such as the V4 or the Mikrograph which were technical marvels, but generated abyssal losses for bottom-line.

Will the last act of Mr. Biver’s recital, the eponymous Biver brand, be successful? Certainly, commercially speaking, but will it become a sustainable brand in the long run after Mr. Biver’s stay on earth?

Time will tell, but the watch industry will remember a marketing pioneer who based all his success stories on the same sound principles: Be first, unique and different!

#15 Georges Kern

Personal Net Worth: CHF 160 million

Total Market Share: 2.6 percent

Brand: Breitling

Georges Kern, CEO of Breitling

When Georges Kern decided to leave Richemont in 2017, some people — including me — questioned if he had just made the right decision to leave a very well-paid job as the head of the specialty watchmakers to join a brand which had definitely lost momentum. The price paid by CVC for the initial 80 percent stake seemed even more questionable at CHF 850 million, which valued the company at more than CHF 1 billion. CVC then successively resold a major part of its equity to another private equity firm, Partners Group, which now owns the majority stake and values the company at a staggering CHF 4.2 billion.

Mr. Kern has done a tremendous job by balancing the brand on three distinctive pillars linked to air, sea and land, with the engagement of brand ambassadors who are dubbed “squads” to imply that they’re part of the brand. The most obvious and — for some diehard fans of the brand — shocking part of the rebranding was to cut the wings in the brand’s logo which stood for Breitling’s dedication to aviation.

Coming from IWC where he had taken a lot of “inspiration” from Breitling to focus on aviation, Mr. Kern wanted to diversify the brand’s positioning and give it a broader basis in order to connect with younger demographics.

The first product launch under the new era was the Navitimer 8, which failed to attract new clients, and worse, disappointed the existing ones. Why? Because the Navitimer became an iconic product with its design of an instrument for the wrist for pilots and many more clients dreaming of being one.

Taking these codes away simply did not resonate with the core and target audience.

That was a wakeup call telling the brand that modernizing icons might be a better idea than trying to reinvent them entirely, and since then, Breitling’s ride on the neo-vintage wave has been a lot more successful with, for instance, the launch of the Premier or Top Time, which are taking their legitimacy from the brand’s legacy. In addition, the partnership in Kenissi Manufacture, a joint venture where Breitling is partnering with Chanel and Tudor, is also giving the brand a lot more horological credibility.

Last but not least, Breitling also has an innovative transversal business model offering ancillary services such as financing your watch with monthly instalments, which is a clever way to give access to younger demographics seeking to acquire luxury goods. Breitling was also amongst the first adopters of non-fungible token (NFT) technology in order to track a watch during its decade-long itinerary.

The most recent extensions of the brand are the opening of cafés and restaurants to create branded spaces of conviviality where selling products is not the primary purpose, but creating bonds with the clients is more important. Finally, the recent acquisition of Universal Genève revives another chapter for the storied brand. It’s one of the most anticipated returns in all of watchmaking and we can’t wait to hear about this success story.

#14 Miguel Rodriguez

Personal Net Worth: CHF 300 million

Total Market Share: < 1 percent

Company: The Festina Group

Brand: Festina, Lotus, Candino, Jaguar, Kronaby, Calypso, Lotus Style, Lotus Silver and Perrelet

Miguel Rodriguez, Owner and President of the Festina Group

He also likes to tell the story of how he was smuggling watches to Spain to make some money on the side which later on allowed him to buy his first Swiss watch brand, Festina. This laid ground to a group comprising other brands like Candino, Jaguar, Lotus (watches and jewels) and Perrelet.

The brand portfolio also includes Swedish brand, Kronaby which is making hybrid smartwatches. This links to the know-how of Soprod Quartz, one group owned manufacturing company capable of developing smartwatches from with proprietary technology.

#13 Ted Schneider

Personal Net Worth: CHF 600 million

Total Market Share: < 1%

Brand: Norqain

Ted Schneider, Co-Founder and Board Member, Norqain

Even after he sold the majority of Breitling to CVC Capital Partners in 2017, Teddy Schneider had to show that he was still capable of having success in the watch industry, hence his investment in Norqain, which is a fast growing generalist brand with quite a conventional branding strategy made up of testimonials — sports and wildlife preservation — and contemporary brand values such as ocean cleaning. The board is advised by industry legend Jean-Claude Biver, which is probably a good decision to bring some out-of-the-box thinking to the table, and is helmed by one of the most dynamic young leaders in the industry, Benjamin Küffer (pictured, right), who is joined by his sister Caroline as the brand’s head of communications.

Ben Küffer, Co-Founder and CEO, Norqain

We will never know why Mr. Schneider and his sisters decided to sell the family business and if they regret doing so. Seeing the value of the company quadrupled in five years thanks to the dynamic Georges Kern may trigger some regrets at some point.

Nonetheless, CHF 1 billion for Breitling was good money to cash in and it is clear that Schneider still has an interest in Swiss watchmaking through Norqain.

#12 Vartan Sirmakes

Personal Net Worth: CHF 600 to 700 million

Total Market Share: 1 percent

Brand: Franck Muller

Vartan Sirmakes, Co-Founder of the Franck Muller Group

The watches were not only a lot bigger than any other wristwatch back around then, but the bold dials with oversized numbers were instantly recognizable. The commercial success came overnight when some Italian — yes, the very place where good taste was born and watch trends are launched — football coaches and players started wearing Franck Muller’s watches.

Frank Muller

Even if the brand has lost a lot of traction since more than a decade, it is still a relevant player in the high-end segment with an estimated 21,000 pieces and CHF 250m in watches sold last year. That is a lot, but still a lot less compared with the first decade of this century when it was selling for north of CHF 600m a year.

Without taking away any credit from Richard Mille’s phenomenal success, it is beyond questioning that Richard Mille took some inspiration for the product design from Franck Muller.

On the negative side, the brand which is part of an eponymous group, never succeeded in diversifying its brand portfolio beyond the main brand. All the projects — Karbon, MHR, European Company Watch (the name is already program) and Pierre Kunz — ended in the cemetery of the watch industry.

Even Cvstos which is founded and managed by Vartan Sirmakes’ son Sassoun is not exactly a success story inasmuch as it’s surviving thanks to cross sales from the parent company.

#11 Jacob Arabo

Personal Net Worth: CHF 900 million

Total Market Share: <1%

Brand: Jacob & Co.

Jacob Arabo, Founder, Jacob & Co.

Jacob & Co. is an incredible success story based on the vision of one man, Jacob Arabo, of making 3D fine watchmaking. When he was explaining his vision for his products to his manufacturing partners in Switzerland, they would politely listen to him, but wouldn’t buy into his weird ideas.

One day, a talented and creative watchmaker presented him with the concept of a highly complicated triple-axis tourbillon combined with three other arms, each displaying either a sphere or “Jacob-cut” diamond with 288 facets, and finally the time display, each turning at a different speed. Together with Valérien Jaquet of Concepto, Jacob proceeded to make this concept a reality.

He named it the Astronomia, and with it, Arabo propelled himself through sheer force of will into the horological big leagues.

The extraordinary idea behind the mechanical concept, which is already a feast for anyone interested in mechanical complications, is that the variations of displays are almost infinite. Jacob & Co. timepieces and jewelry — accounting for 75 percent and 25 percent of the brand’s sales, respectively — are bold and very distinctive. The brand has seen a very strong acceleration post-COVID of its sales, which grew 132 percent from 2020 to 2022.

Certainly, it is a very interesting dual brand capable of creating marvels for affluent clients around the world who dare to wear very distinctive watches and jewels — and who are capable of paying north of CHF 600,000 for an Astronomia timepiece. The Swiss watch industry is by now not laughing anymore at that crazy American’s vision of a different way of making watches.

Benjamin Arabov, CEO, Jacob & Co.

Jacob followed up on the Astronomia with a ceaseless assault of mind-blowing, technically innovative finery, including the Bugatti Chiron Sapphire Crystal watch with its tiny functional W16 engine and the Godfather minute repeater with its multi-axis tourbillon. One huge asset to Arabo’s vision is his son and CEO of the brand, Benjamin Arabov, who is a very well-liked, friendly and passionate young man showing great promise for the future.

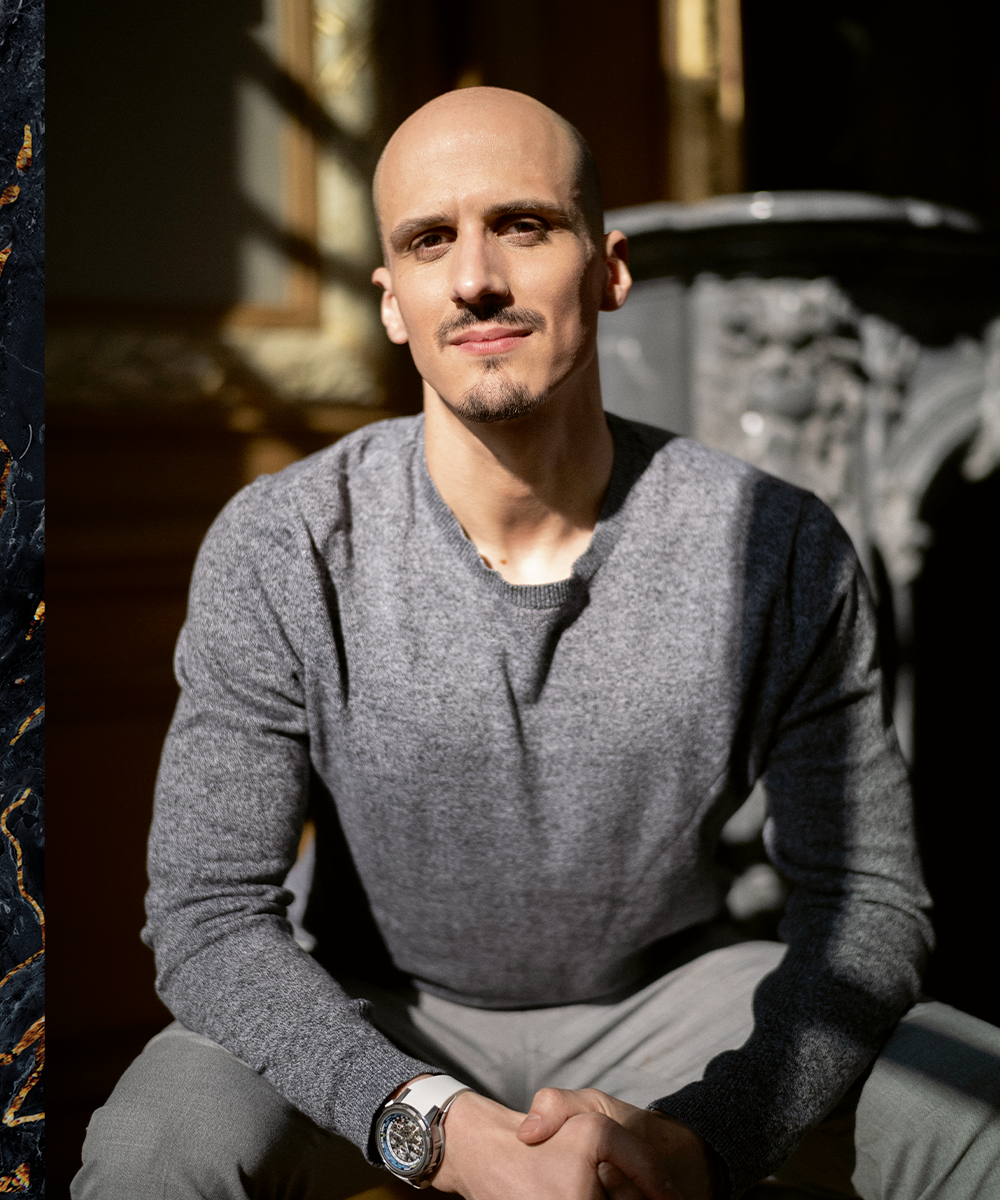

#10 The Mille and Guenat Families

Net Worth: CHF 1.6 billion

Total Market Share: 2.7 percent

Brand: Richard Mille

Richard Mille

“You can divide the history of watchmaking into two distinct eras,” says Wei Koh. “The time before Richard Mille and the time after, so seismic is his impact on watchmaking as we know it.”

Today Richard is, in Tour de France mountain classification terms, “Hors Categorie,” meaning that it is outside of all categories and in a realm of its own. What else can you say about a brand whose average price is a staggering USD 250,000.

Richard Mille is the perfect case study for any luxury marketing student because it reunites all ingredients needed for a success story. First, a price positioning which was so bold when the brand was launched in 2001 that it shocked the world of high-end watchmaking.

Selling the RM 001 at USD 135,000 was seen as a “crime de lèse majesté” towards a brand like Patek Philippe which, at that time, was selling only one tourbillon and for a lot less. Asked about this audacious price positioning, Mr. Mille replied: “We’re not competing with anyone!”

Alexandre Mille, Brand Director, Richard Mille

The second ingredient is a bold brand claim: “A racing machine on the wrist.” This says it all for the product inspiration taken from racing cars and their perpetual quest for new materials and new concepts.

Richard Mille is always at the forefront of using new materials for the sake of innovation and inventing new mechanical marvels. Despite what some critics bemoan — most of them don’t have the necessary technical background — the watches are very sturdy and reliable.

Tennis legend Rafael Nadal has demonstrated this many times by wearing the RM watches while playing high intensity games. Conceiving a tourbillon such as the RM 027 capable of resisting a few G’s each time Nadal hits the ball is a remarkable achievement.

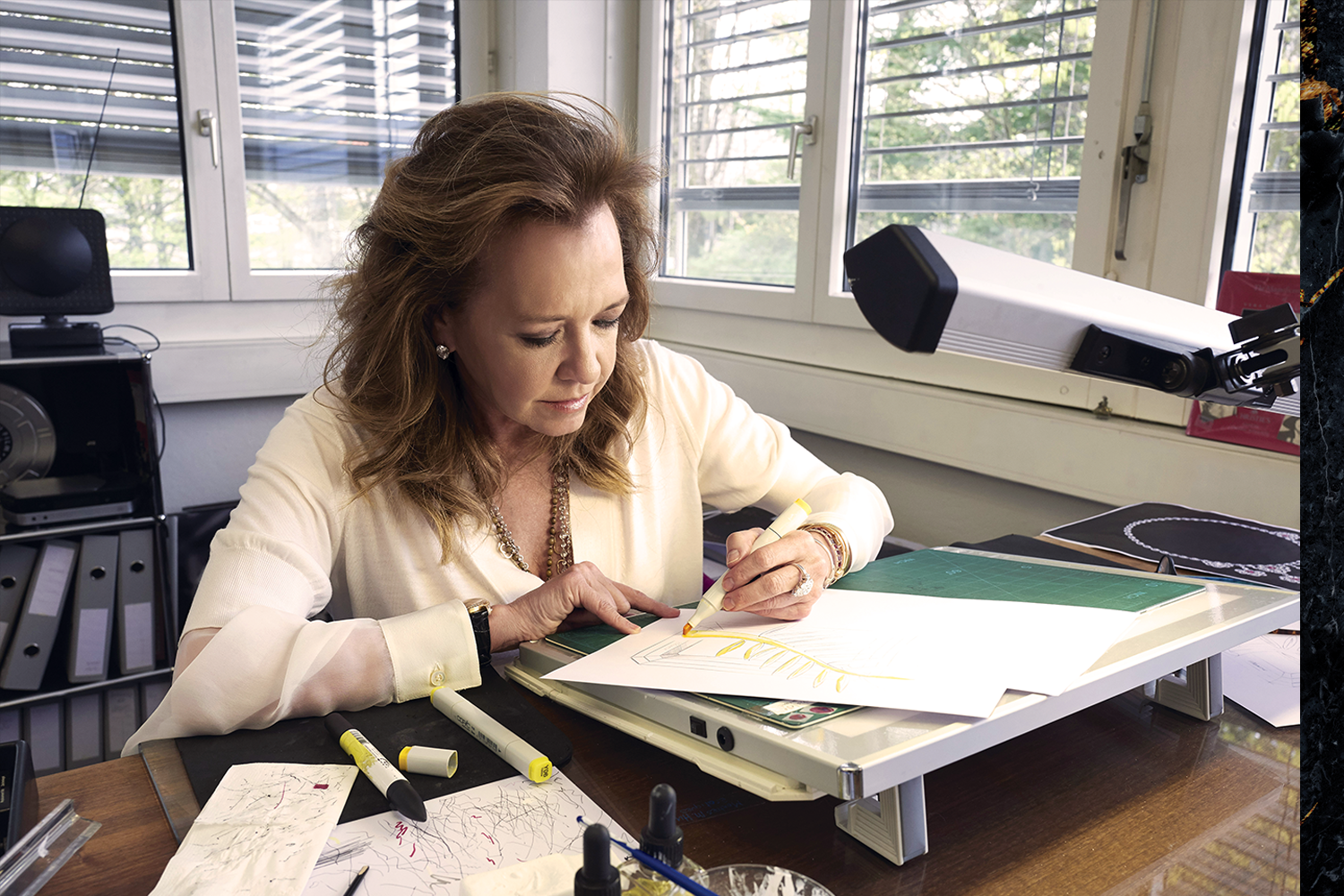

Cecile Guenat, Director of Creation and Development, Richard Mille

Last but not least, you need a very distinctive design which Richard Mille achieved right off the bat, with a barrel-shaped case and quite massive dimensions. Any new reference is a limited edition and, needless to say, all of them are instantly sold through and reach tremendous prices on the secondary market.

And perhaps last of all, the watches have to be extraordinarily stunning from a visual richness perspective, which they are.

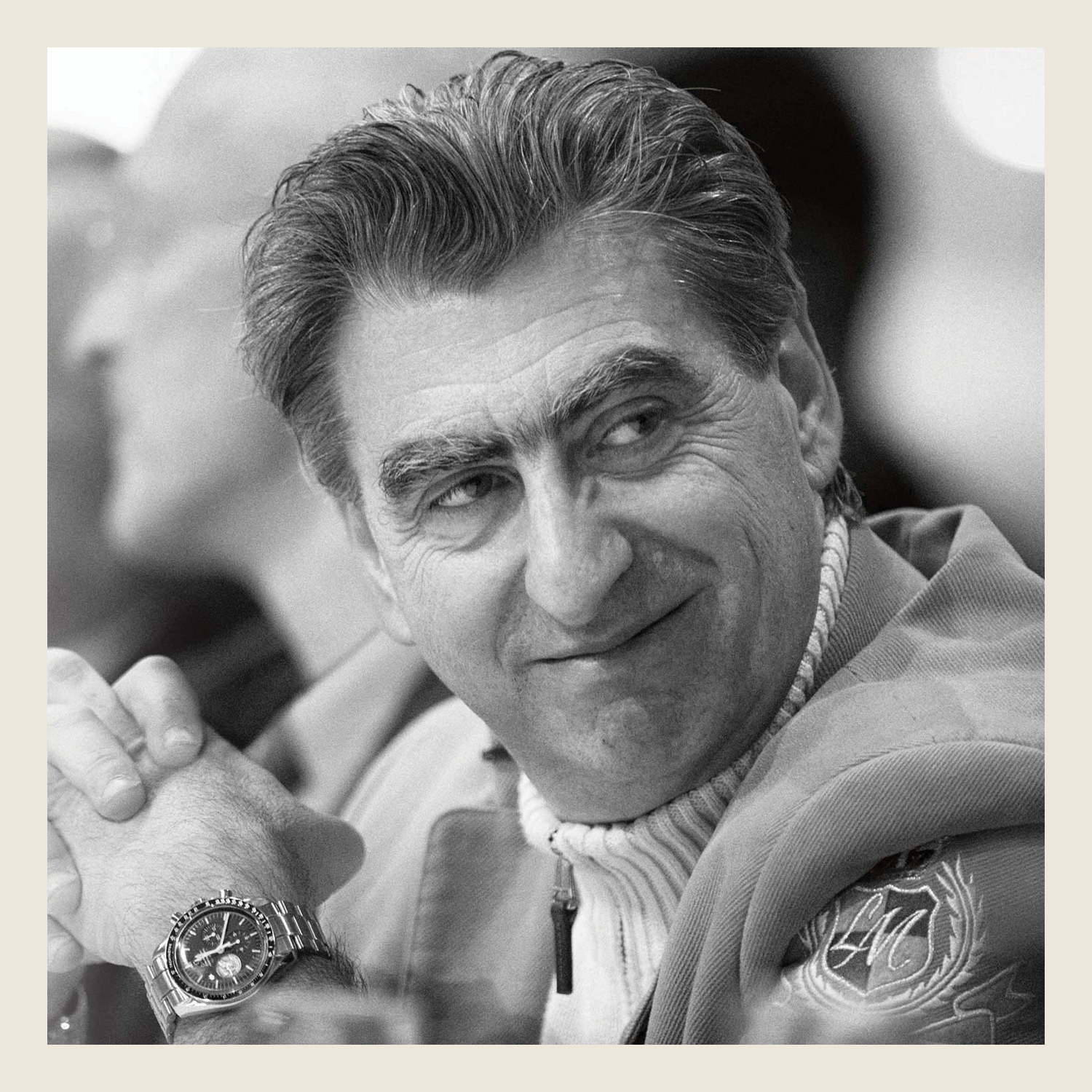

Dominique Guenat, Co-Founder, Richard Mille

The brand’s unique success, which surpasses what Franck Muller achieved in the late 1990s and early 2000s, is also built on a very strong business strategy. One partner, Dominique Guenat, is in charge of manufacturing and Richard Mille is in charge of branding.

Three other partners are taking care of the worldwide distribution and managing the 41 mono-brand stores retailing exclusively the 5,200 watches sold last year. Roughly half of those boutiques are brand-owned and the other half are joint ventures (JV) with a 15 percent gross margin left for the JV partner.

The value of Mr. Mille’s wealth is estimated on his stake in the brand’s equity taking into account that, one, Audemars Piguet owns 10 percent, which gives Richard Mille unlimited access to Audemars Piguet Renaud & Papi, and two, that the retail activities are split on three different regions and owned by other business partners.

Therefore, the overall brand value with consolidated sales at CHF 1.3 billion in 2022 can be estimated at CHF 10 billion due to what is probably the highest margin of the watch industry and a totally integrated value chain with an integrated manufacture and a 100 percent direct-to-consumer retail network.

Amanda Mille, Brand and Partnerships Director, Richard Mille

Perhaps most impressive of all is that Richard Mille is the first entrepreneur who has assured his succession plan with his business now guided by the able hands of his children such as Amanda Mille, who is in charge of all partnerships, and the wonderful, affable and painstakingly humble Alex Mille, who as a sign of his dedication has moved to the manufacture so he can be part of the daily management of its industrial competences.

#9 The Scheufele family

Net Worth: CHF 2 to 3 billion

Total Market Share: 1 percent

Brand: Chopard

Karl-Friedrich Scheufele (left), Co-President of Chopard and President of La Chronométrie Ferdinand Berthoud, with his father, Karl Scheufele III (middle), and son, Karl-Fritz Scheufele (right).

The owners of Chopard, the elegant Scheufele family, bought the Swiss watch brand in 1963 to reinforce their legitimacy in the watch industry. The family was already active as a jewelry manufacturer with its own watch brand under the name Eszeha since 1904.

Chopard is one of the very rare brands competing in different luxury product categories, but the vast majority of the top line — an estimated 97 percent — is being generated by jewelry (55 percent of the 97 percent) and watches (45 percent). The diversification into accessories was never successful and the only product category generating a substantial positive gross margin are the perfumes which are a pure franchise business.

Caroline Scheufele, Co-President of Chopard

Unlike the main competing brands — such as Hermès and Cartier — and despite having been one of the first jewelry and watch brands to go direct-to-consumer with a substantial number of brand-owned stores (around 35 worldwide) and franchisees (around 110), Chopard has yet to truly establish success with its accessories, except in its own boutiques as gifts.

Chopard has a unique brand asset or unique selling proposition (USP) with the legendary Happy Diamonds even though it is no longer patent protected. Happy Diamonds is an extraordinary product concept, because it can be endlessly reinterpreted in different colors, sizes, materials, patterns and even shapes.

It is certainly Chopard’s hero product, generating a substantial proportion of the brand’s sales in its different versions, and iconic both for the watches and the jewelry. The flip side of owning such a wonderful asset is that the brand has lost a lot of traction especially in the watch business by not innovating enough.

The Mille Miglia product family launched in 1988 had shown the way by increasing the sales fivefold when it was still managed by a talented product director — Jean-Frédéric Dufour, no less, and yes, the same one who’s now running the show at Rolex.

In the past, Chopard faced challenges to establish the L.U.C in the elite league of mechanical watches, despite having developed top-notch movements which doesn’t have to fear any comparison with the likes of Patek Philippe or A. Lange & Söhne, but lacks brand sexiness for the die-hard collectors. However, in recent years, Chopard L.U.C in particular the stunning Revolution Award-winning 1860 Lucent Steel, has become one of the most sought after timepieces on the market.

It is nice to see that after 26 years, Chopard L.U.C is getting its much-deserved time in the spotlight. Chopard has also created the very appealing sports chic timepiece, the Alpine Eagle, to great results.

And Scheufele’s dedication to movement innovation has yielded what Wei Koh feels is the “best sounding minute repeater in modern horology,” the L.U.C Full Strike. Finally, Scheufele has also successfully launched Ferdinand Berthoud, which now has a cult collectibility status expressed by a waiting list of three years for some of its models.

It will be interesting to see how the third generation (or the fifth generation, if we take into account the pre-Chopard legacy of the family), in particular the very promising and young Karl-Fritz Scheufele, will bring their unique intelligence and energy to the brand and bring it back on a virtuous circle.

#8 The Hayek Family

Company: The Swatch Group Limited

Net Worth: CHF 3.5 billion

Total Market Share: 19.8 percent

Brand: Breguet, Harry Winston, Blancpain, Glashütte Original, Jaquet Droz, Léon Hatot, Omega, Longines, Rado, Union Glashütte, Tissot, Balmain, Certina, Mido, Hamilton, Swatch, Flik Flak

Nick Hayek Jr., CEO, Swatch Group

Without the Swatch Group, the Swiss watch industry would have likely perished during the Quartz Crisis. Its savior, Nicolas Hayek Senior, is often credited with rescuing the Swiss watch industry from the brink of disaster by creating the Société de Microélectronique et d’Horlogerie (SMH), the predecessor of the Swatch Group, in 1983 and merging two fledgling groups to form one strong entity where two brands were the cornerstones: Swatch was to regain lost ground from the Japanese competitors and Omega was to become the crown jewel again.

At the same time, Hayek also created Swatch watches which became a mass-produced, highly popular Swiss-made alternative to the Japanese quartz fare. He purchased and uplifted the greatest name in Swiss watchmaking — Breguet — with the creation of extraordinary timepieces, traveling exhibitions of the great watchmaker’s masterpieces, and the re-creation of the legendary Marie Antoinette pocket watch unveiled at an extraordinary launch at the Palace of Versailles.

Nayla Hayek, CEO, Harry Winston

Today, the Swatch Group is at the center of the Swiss watch industry not only for managing 16 brands which are almost exclusively — with the exception of Harry Winston which is an iconic jewelry brand also making watches — selling watches. Hayek’s theory was mainly built on the concept of a pyramidal positioning of each brand and mutualizing the production capacities rather than having dedicated production capacities for each brand.

Every brand also got its territory (besides a price positioning) in order to make sure that two brands wouldn’t have overlapping and hence competing products and communication efforts. This worked very well and positioned the Swatch Group as the biggest watch group in the world while at the same building strong brands and a unique manufacturing entity.

But purists would occasionally mourn the loss of legendary movements such as the Longines 13ZN chronograph caliber, replaced by more accessibly priced industrial movements befitting the brands’ price positioning.

Marc A. Hayek, President and CEO of Blancpain

In recent years, however, things have become a little more heated with the group’s number one, Omega, helmed by the brilliant Raynald Aeschlimann, losing ground against Rolex — which has become more aggressive in recent years — and being challenged by other brands such as Cartier for women’s watches and Breitling on the overall. The market has changed considerably with an ongoing polarization at the top end, with high-end brands such as Rolex, Audemars Piguet and Patek Philippe becoming luxury brands and surfing on an overall positive trend for the whole luxury industry.

Apart from Omega, which is leading the field in its core range price positioning (an average worldwide retail price of CHF 6,500) and generating one third of the group’s sales, but approximately 60 percent of the operational margin, the market headwinds have created challenges on the Swatch Group with a decreasing market share over the years.

The challenges are multiple for a group still strongly led by the family with Nick Hayek Junior performing as the CEO of the group, Nayla Hayek — his sister — is the chairman of the board and Marc Hayek — her son — officially taking care of the luxury segment, but who is mainly looking after Blancpain. Strongly challenged by the success of the smartwatches, Swatch and Tissot have managed to bounce back recently with the massive success of the MoonSwatch (a collaboration between Swatch and Omega) and the successful Tissot PRX, respectively.

It should be said that with the MoonSwatch and now the Swatch Blancpain “Scuba Fifty Fathoms” diving watches, Hayek Jr. has brilliantly capitalized on collaborations within his own group, which has resulted in the creation of a cultural phenomenon, especially amongst the younger generation, the likes of which our industry has not seen since his father hung a massive Swatch watch on the side of a building to announce its arrival. These collaborations have vitally engaged in building watch culture and awareness in the next generation and Hayek deserves to be applauded for this.

On the subject of the next generation, one extremely interesting and promising young Hayek is Nick III, a young man studying hotel management at the elite EHL (formerly known as the École Hôtelière de Lausanne) and one of the most passionate and insightful young collectors Revolution’s founder Wei Koh has met in recent years.

The Swatch Group is very important for the whole structure of the Swiss watch industry, because it is a systemic part of it. The group manufactures and sells two thirds of the overall volume of the Swiss watch industry, and is stricto sensu the only fully integrated industrial manufacture, even though one can argue that Rolex and Richemont are de facto at the same level of industrial integration, at least for the mechanical watches.

#7 Johann Rupert

Company: Compagnie Financière Richemont S.A.

Net Worth: CHF 11.5 billion

Total Market Share: 19.5 percent

Brand: Cartier, Panerai, IWC, Roger Dubuis, Piaget, Jaeger-LeCoultre, Vacheron Constantin, Baume & Mercier, A. Lange & Söhne, Buccellati, Van Cleef & Arpels, Montblanc, Time Vallée, WatchFinder & Co.

Johann Rupert, Chairman, Compagnie Financiere Richemont

Revolution’s founder Wei Koh likes to say, “If Rolex is the King of Sports and Patek is the King of Complications, then Cartier is the King of Elegance.” By far the most important brand within the Richemont brand portfolio, Cartier generates approximately 50 percent of the group sales and 70 percent of the group’s profits.

Now that Cartier’s brilliant CEO, Cyrille Vigneron, has realigned Cartier with its true and proper status as the King of Elegance, the watch division is absolutely on fire, becoming the second largest watch brand on the planet after Rolex. Cartier is one of the very few brands perceived as being genuinely a luxury player and for which the value perception is higher than its actual market positioning.

For instance, its feminine watch segment is competing against pure players such as Omega, which might seem surprising but the maison is generating its “bread and butter” with watches priced at an average worldwide retail price of CHF 5,400, which is even slightly below the entry price of an Omega. The magic of such a brand is that despite generating quite a high volume with around 620,000 watches last year, it keeps the aura of a luxury brand with a high brand equity.

There is only one other comparable that comes to my mind when asked if there’s any such brand around, and that is the LVMH-owned Tiffany & Co.

Cyrille Vigneron, CEO of Cartier

The specialty watchmakers, as Richemont calls them, are brands that are mostly positioned in the premium and luxury price segments. Richemont has certainly a strong know-how and expertise in luxury as the recent success of Vacheron Constantin is showing, with the brand moving steadily up the rankings; this was certainly helped by the success of its Overseas product family, which allowed it to attract a younger clientele.

Vacheron has quietly become one of the Richemont Group’s and our industry’s greatest success stories and, by many accounts, it will pass the CHF 1 billion mark in revenue this year. It is also a key player in multiple categories, from historical watches such as the Historiques American 1921 and Cornes de Vache 1955 to high complications, métiers d’art watches, sports watches like the Overseas, and now the much sought after Reference 222, aka Brad Pitt’s favorite watch.

All this is down to the exceptional leadership of its CEO Louis Ferla, whose favorite saying is, “Strong sales are just the result of a job well done.” While it is still not clear who will replace Vigneron at Cartier should he step down at the normal retirement age of 65 in two years, the smart choice, in my opinion, would be Ferla.

Louis Ferla, CEO, Vacheron Constantin

The group has also succeeded in developing a formidable manufacturing pool with movement manufactures dedicated not only to a single brand such as Jaeger-LeCoultre, but also serving sister brands in need of R&D and manufacturing capacities. Richemont owns Valfleurier, which fulfils the task of producing high volume calibers for some of its brands, and thus reducing the dependency from Swatch Group’s industrial arm, ETA.

And this vertical integration, although often questioned by financial analysts for its capital and labor cost-intensive needs, brings a lot of value for the group.

#6 The Stern Family

Net Worth: CHF 12 billion

Total Market Share: 5.1 percent

Brand: Patek Philippe

(from left): Philippe Stern, Honorary President of Patek Philippe, and his son Thierry Stern, the current President

When it comes to brand equity, there is no greater brand than Patek Philippe and that is down to the brilliance in leadership of the Stern family, now in its fourth generation at the helm. Many say that Patek Philippe is considered to be the “Rolls-Royce” of watch brands. However, I feel the far more accurate statement is that Rolls-Royce is the Patek Philippe of automobiles.

That is, even though Patek is neither the oldest nor historically the most successful brand. In fact, the Stern family had to buy the brand in 1932 because the company was in great financial despair as a result of the overall disastrous economic situation of the Great Depression, where it ended up owing the Stern dial manufacturing company a lot of money.

And that was when the magic began to happen with the creation in 1932 of the Reference 560, in 1936 the Reference 130 and in 1941 the two greatest complication watches ever created, the References 1518 and 1526. Following that, Patek Philippe became the unrivaled King of Complications and remained so ahead of its competition it should be placed in a category all its own.

Perhaps most special of all is that Patek Philippe, unlike Rolls-Royce which has been owned by BMW since 1998, is still 100 percent privately owned by the Stern family and run like a family business.

Patek Philippe has also become the referential watch brand in the categories of the high-end and the sports chic stainless steel watch with its iconic Nautilus and Aquanaut models. The brand’s image has been fostered by a very strong communication campaign which, since 1996, has staked the claim that “You never actually own a Patek Philippe. You merely look after it for the next generation.”

The claim is so strong because it not only implies that the timepiece you have acquired is there to stay for eternity and will be passed on from generation to generation, but more importantly, it also binds the brand into your family legacy.

Patek Philippe has invested tremendous amounts of money into its manufacturing capacities in Geneva and elsewhere in Switzerland. Starting with the inauguration of the new manufacture of Plan-les-Ouates in 1996 and steadily increasing its production and sales volumes, the company invested billions of Swiss francs in buildings, machines and, last but not least, training people.

The latest investment amounts to CHF 600 million for the building and the machines, and everything is self-financed. The company doesn’t owe a cent to any bank and the genius that is Mr. Philippe Stern — Thierry Stern’s father who is the actual owner of the brand — paid in advance all the succession fees in 2014 so that his children, Thierry and his sister Christine, would not have to take on a heavy cash burden to pay for those.

Those taxes were not paid by petty cash, but at a whopping CHF 415 million created quite an uproar in the press because everyone was guessing who could have paid that substantial amount of money at once. While many names have been mentioned as the greatest leader in watchmaking of all time, it is Revolution founder Wei Koh’s opinion that “Philippe Stern is the watch industry’s greatest innovator, pioneer and leader.”

He built the world’s greatest watch museum, helmed the world’s greatest watch campaign, created the most single most beautiful watch of the modern era, the Reference 5004, and positioned Patek and especially its complications to be the unobtainium of the watch world.

#5 The Audemars and Bottinelli families, other minority shareholders

Net Worth: CHF 15 billion

Total Market Share: 4.7 percent

Brand: Audemars Piguet

Jasmine Audemars, Chairwoman of the Board of Directors, Audemars Piguet

Once thing that the outgoing CEO of Audemars Piguet, François-Henry Bennahmias, can be credited with is the phenomenal value creation he has delivered in his 11-year tenure as CEO. From an estimated CHF 2 billion brand value with CHF 630 million in sales, Bennahmias has taken the brand to a staggering CHF 15 billion valuation. How?

First of all, by executing a long-term strategy dedicated to transforming Audemars Piguet into a luxury brand. Then, it was about adopting a coherent attitude both on-site and online, as well as reducing the retail presence to mono-brand boutiques rather than multi-brand retailers carrying a multitude of competing brands.

The positive by-product of this, of course, is that the brand has earned the retail margin which massively increases profitability. Next, AP is focusing the product offering on one iconic product, the Royal Oak, and also taking some risks by launching a controversial new product family, the Code 11.59, which in fact picks up all the codes of the Royal Oak.

Incidentally, Code 11.59 is already contributing 12 percent of the brand’s sales and even though this seems marginal, any other product collection before that never came near to becoming a sustainable product family. In fact, the Millenary and Jules Audemars collections were discontinued recently.

Olivier Audemars, Vice Chairman of the Board, Audemars Piguet

The company has invested substantial amounts of money into its production facilities with the most recent initiative being the construction of a new manufacture in the Canton of Geneva, after having inaugurated new production facilities in Le Brassus and in Le Locle, Canton of Neuchâtel. On top of the verticalization of its activities, Audemars Piguet has also created a museum which is outstanding by its modern scenography and can be only visited in small groups to preserve the unique experience of discovering the brand’s unique heritage.

Although the historical collection can’t compete with the Patek Philippe Museum in Geneva in terms of collection richness, it is a lot more modern and offers a view on some of the brand’s artisans working at their benches.

François-Henry Bennahmias, CEO of Audemars Piguet

Even though 2022 was already an exceptional year with the 50th jubilee of the brand’s iconic Royal Oak and a firework of limited editions relating to this commemoration, 2025 will mark the 150th birthday of AP and we can certainly expect some marvels. Finally, as he departs, it is clear Bennahmias still has his eye on increasing revenue past the CHF 3 billion mark by targeting the female customer.

As he explained to us, “I want our women’s watches to be the Birkin bags of watchmaking. No luxury watch brand today has achieved parity between male and female customers; we may well be the first.” Was this part of the decision-making in hiring a female CEO in Ilaria Resta? Bennahmias claims it isn’t but it certainly can’t hurt.

#4 The Hans Wilsdorf Foundation

Net Worth: CHF 70 to 80 billion

Total Market Share: 31 percent

Brand: Rolex, Tudor, Carl F. Bucherer, Bucherer Group

Hans Wilsdorf, Founder of Rolex and Tudor

Regardless of its ranking on this index, there is one clear unassailable and irrefutable truth: Rolex is the King of Watches. Rolex does so much to engage the general public’s interest in luxury watches that Wei Koh, Revolution’s founder, states, “Without Rolex, there could be no Swiss watchmaking industry because everything is built on a foundation that this brand creates.”

Rolex is the epitome of a well-managed luxury brand, beyond being a company making watches. Having a single shareholder which is a foundation — Mr. Wilsdorf’s estate — makes things easier in terms of long-term vision, as there is no pressure to pay dividends or show growing results quarter after quarter as listed companies tend to.

Neither the company nor the Wilsdorf Foundation publishes any figures, but the benefits generated by the watch brands — because there is also sister brand Tudor — are being generously redistributed by the foundation. Rolex itself is also supporting many good causes around the world.

Those are substantial amounts of money being given away, as we are talking up to CHF 300 million every year through the Wilsdorf Foundation alone. Hence, buying a Rolex is also helping good causes — which might help take the edge off of waiting six years (probably more) for your Daytona.

Jean-Frédéric Dufour, CEO of Rolex

Rolex has a dominant position in the luxury watch segment that not a single luxury brand can claim to have. It has an estimated 40 percent market share of the U.S. luxury watch market, which is also the biggest in the world.

The brand sold 1.2 million watches per annum in 2022 which generated CHF 9.3 billion in sales. But this is at wholesale because, until this year, Rolex worked exclusively with partners creating almost CHF 5 billion for the world’s best, and let’s face it luckiest, retailers on the planet.

I had written about the Bucherer deal in an article here that it was quite surprising that Rolex would leave a good CHF 4.65 billion on the table by not owning its own retail. Back then, I posed the question: “Now let’s imagine that Rolex decides to integrate their retail network entirely or partially. What would it mean in terms of profitability and the consequences on the worldwide retail structure?”

For five years, Rolex and Patek Philippe were “anomalies” in the wake of a direct-to-consumer strategy where luxury brands were gearing towards more control of the value chain to the client’s wrist. It’s not so much about capturing more margin, but foremost about controlling the brand’s image and collecting client data.

After having launched its Certified Pre-Owned program with Bucherer, the next step which had been in the pipelines for years, was just logical with the integration of its most important retailer. And for sure Rolex won’t stop in its consolidation of its retail activities.

The next acquisitions — yes, plural — are on the radar and these will be significant and game changers, just as the acquisition of Bucherer has been.

Rolex is one of the very few watch brands which can truly be described as a fully integrated manufacture and is continuously investing substantial amounts of money in its production capacities. The last 20 years has seen billions of Swiss francs being invested both in Geneva and Bienne, where the brand manufactures its movements. It also has as CEO one of the most brilliant master tacticians and visionaries, Mr. Jean-Frédéric Dufour, and we are only beginning to see the start of what he has in store for us.

#3 The Wertheimer family

Company: Chanel Limited

Net Worth: CHF 90 billion

Total Market Share: 1 percent

Brand: Chanel

Gérard Wertheimer (left), Co-Owner of Chanel and Head of the watch division, with his brother Alain Wertheimer (right), Co-Owner and Chairperson of Chanel

Very few luxury brands are based on such strong fundamentals as comparable with Chanel, which is best known for its fashion and bags, but yet has also successfully managed to diversify with other product categories such as watches. One remarkable accomplishment is the fact that the J12 watch launched in 1999 has already achieved the status of an icon, not only thanks to a distinctive design, but also clever marketing.

Unlike what Jean-Claude Biver preaches, you don’t need to be first. What you need to do is make people believe that you master it best and that was what Chanel had done when it launched the J12 in ceramic, 13 years after Rado which is no longer today the “King of Ceramic.”

Chanel immediately signaled that its ambitions in watchmaking were going beyond just making an accessory product. The brand immediately invested in production facilities in Switzerland and began producing ceramic components at a company called Châtelain (which also produces the ceramic bracelets and cases for even some of the most desirable brands in Swiss watchmaking).

It then went on to buy Romain Gauthier’s movement manufacture with which it was already collaborating for mechanical movements such as the Monsieur Caliber. And most importantly, Chanel is one of the partners of the powerhouse that is Kenissi Manufacture, making mechanical movements for Breitling, Tudor and the brand’s J12.

Chanel has also taken a 20 percent stake in F.P. Journe in 2018, but this seems more patronage than a strategic business move, unless there is a shareholders’ agreement in place with a right of preemption to ensure the long-term growth of the eponymous niche brand.

#2 The Hermès family

Company: Group H51

Net Worth: CHF 125B

Total Market Share: 2%

Brand: Hermès

Pierre Alexis Dumas, Artistic director of Hermès

The epitome of a luxury brand, the maison Hermès had decided about a decade ago to also become a serious player in the field of watchmaking. A luxury brand needs to propose certain accessories to lure aspirational clients into its temple; for instance, perfumes, eyewear or writing instruments are a clever way to lower the entry ticket and generate sometimes substantial revenues.

However, the value perception by the clients can sometimes be negative if they perceive it as a misalignment with the brand’s overall positioning — and that was the case with Hermès’ watches before the Parisian maison decided to up its game with serious watchmaking.

Axel Dumas, Executive chairman of Hermès

The collaboration with Vaucher Manufacture of which Hermès owns 25 percent gave it immediate access to mechanical movements perceived as being credible, but it didn’t land an immediate commercial success. The brand needed also to do a serious cleanup of its existing product collection with too many quartz proposals and, overall, too many different product families.

Today, Hermès is proposing a solid collection with five product families for men’s and six for women’s watches. Specifically, the H08 has the potential to become an icon because it ticks all the boxes of the brand’s design codes with its instantly recognizable design, and stands for the brand’s ambitions to play a leading role in the sports chic segment.

The strength and aura of the brand allows it also to sell major timepieces in the elite league of watchmaking with grand complications such as tourbillon minute repeaters selling at more than CHF 300,000. It even creates unique pocket watches with designs that are incredibly creative and not necessarily the ones you would expect from a very conservative maison.

In just five years, Hermès has more than tripled its sales to CHF 521 million in 2022 and is growing a lot faster than the industry’s average. It should achieve an approximate CHF 600 million in sales this year.

Laurent Dordet, CEO of Hermès Horloger

The confirmation that Hermès is on track with its strategy is given by its archrival Louis Vuitton, which recently adopted exactly the same approach of positioning its current collection on a much higher level than what it used to be. As managing director of Hermès’ watch division, Laurent Dordet is understated, soft-spoken and humble but possesses an admirable track record over the last eight years, developing a strong sense of identity for Hermès watches that capture the maison’s strong sense of whimsy and poetry.

#1 The Arnault Family

Company: LVMH Moët Hennessy Louis Vuitton

Net Worth: CHF 150 billion

Total Market Share: 6.3 percent

Brands: TAG Heuer, Hublot, Bulgari, Zenith, Louis Vuitton Horlogerie, Dior, Chaumet and Tiffany & Co.

Bernard Arnault, Chairperson of LVMH

Even though the recent market correction was quite hefty (-23.5 percent in six months), LVMH is still the most valued luxury corporation in the world at CHF 317 billion, which is still almost twice the value of Hermès and seven times that of Kering. Hence, at the time of writing, Bernard Arnault is still the second richest man in the world with an estimated wealth of CHF 150 billion.

And even though sales of watches account for only 6 percent of the group’s total revenues with an estimated CHF 4.7 billion out of CHF 79 billion, LVMH clearly has big ambitions to grow this business unit. Currently with 6.3 percent market share, the group is only in fourth position behind Rolex, Swatch Group and Richemont, but everybody knows that Arnault has never been satisfied to play second fiddle in any one of his active market segments.

We highlighted recently that Louis Vuitton has decided to change gears for its watch business, not loudly, but in a very elegant and smart manner. Even though LV has a huge potential to grow its watch business, the real growth in order to become a major player in the watch business will be through a major acquisition, and there aren’t many candidates available out there.

At the same time, Bulgari has carved a strong niche for itself in the sports chic category with the excellent Octo Finissimo. The company is ably led by Jean-Christophe Babin and his team, which consists of the likeable and diligent Antoine Pin and the talented Fabrizio Buonamassa Stigliani.

Frédéric Arnault, CEO of TAG Heuer

Interestingly, two of Arnault’s five children are now active in the watch division, with Frédéric as the CEO of TAG Heuer and Jean who is the head of Louis Vuitton Horlogerie. Frédéric is said to be leaving TAG Heuer to take up another position within the same division; he is to be replaced by the dynamic Julien Tornare, formerly from Zenith.

Jean is showing very promising results at making LV an even more credible player based on La Fabrique du Temps’ manufacturing capacities. He’s also been planning to relaunch Gérald Genta and Daniel Roth, both of which were dormant at sister brand Bulgari.

Jean Arnault, Director of Watches at Louis Vuitton

So far the Arnault siblings have proven themselves to be considerable assets to their family business and are amongst the most dynamic young players in the industry.

On the overall, with pure watch players like Hublot, TAG Heuer and Zenith holding fort, along with some sister brands carrying compelling watches in their product offering such as Bulgari, Dior and Tiffany, LVMH already carries quite an extensive brand portfolio which they can — and will — develop.