Auctions

Good, Better, Best: Watch Auctions Record Resounding Success in First Half of 2021

Auctions

Good, Better, Best: Watch Auctions Record Resounding Success in First Half of 2021

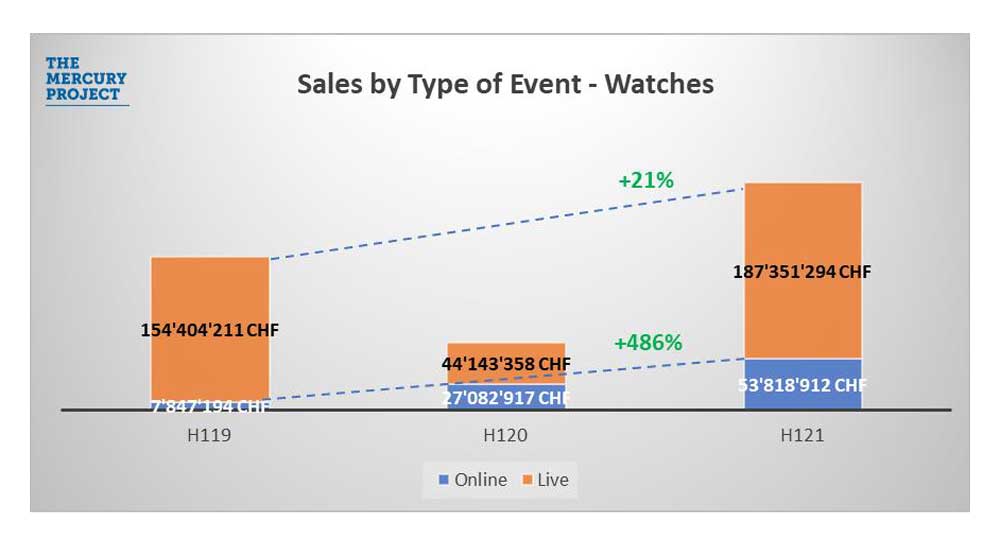

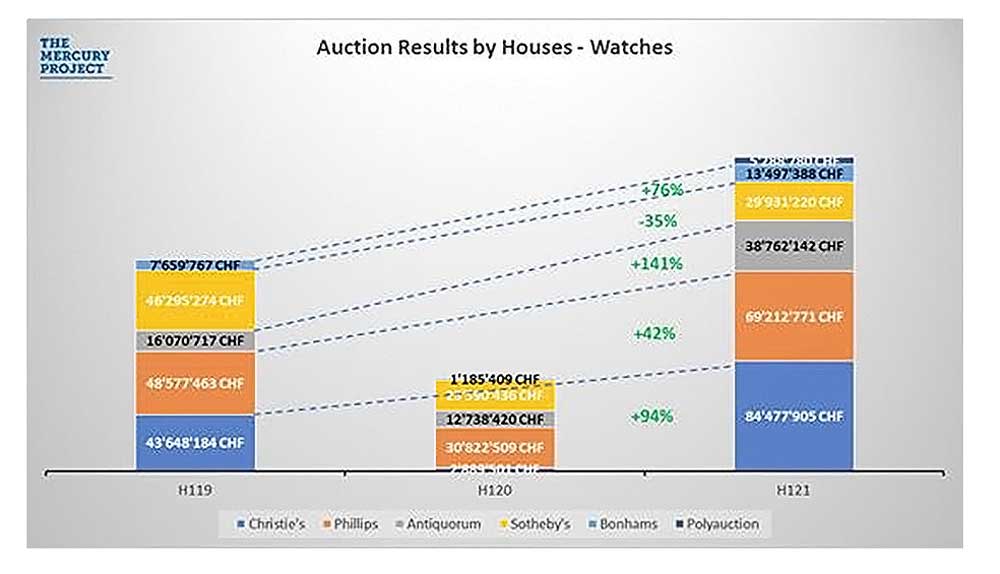

According to The Mercury Project’s latest Hammertrack report, the key players—Christie’s, Phillips, Sotheby’s, Antiquorum, Bonhams and Poly Auction—recorded a jump of 49 percent from 2019 with sales worth CHF 241 million in the first half of this year.

According to The Mercury Project’s latest Hammertrack report, the key players—Christie’s, Phillips, Sotheby’s, Antiquorum, Bonhams and Poly Auction—recorded a jump of 49 percent in sales in the first half of 2021 as compared to 2019.

Helped by a heavy dose of online events and a wide array of offerings for new bidders, luxury watch auctions picked up steam in the first quarter of 2021

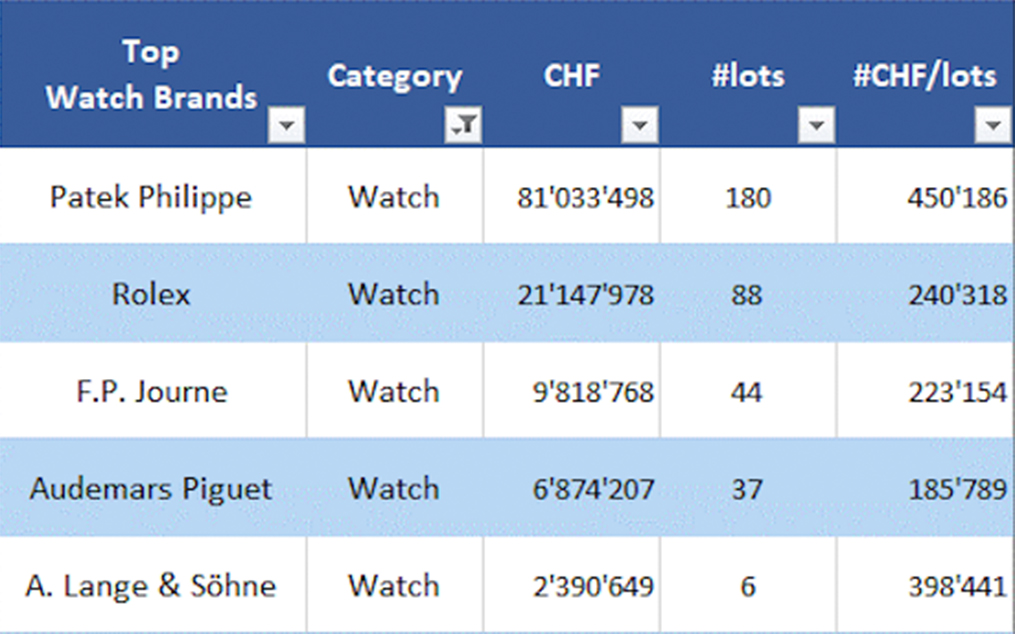

It is no news that Patek Philippe continues to rule the pole position in the auction world with sales worth a whopping CHF 81 million in the first six months of 2021. However, what is surprising is F.P.Journe’s rise within the top three ranks this year. With total sales of CHF 9.8 million from 44 lots, Journe now stands next to Rolex, which recorded a bumper first half with CHF 21.1 million worth sales so far.

The top 5 watch brands at auctions (Source: The Mercury Project).

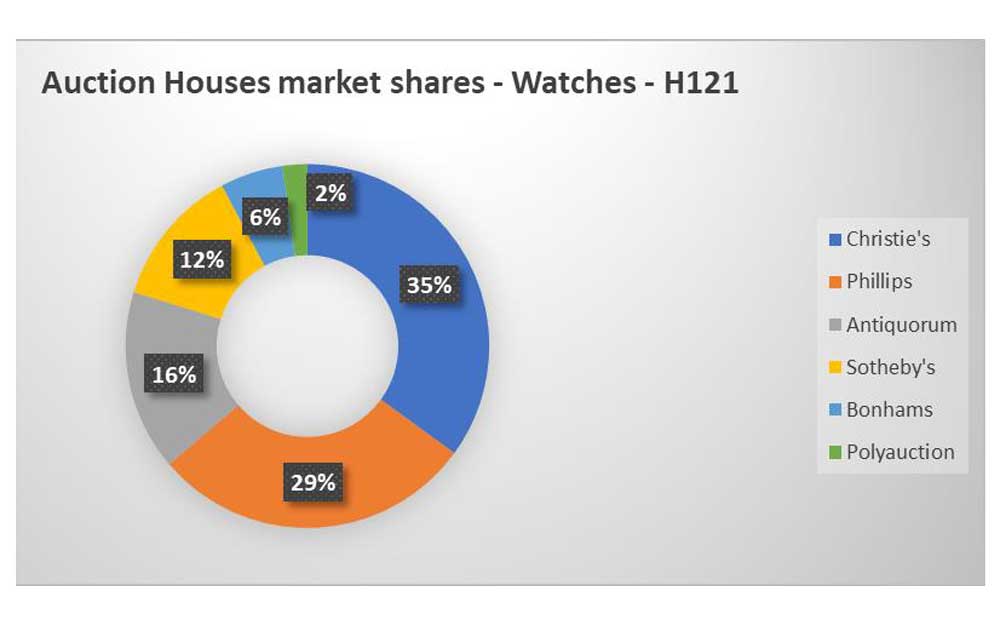

Christie’s took over Phillips as the leading auction house in the first half of 2021.

Millionaire lots at various auctions accounted for 17 percent of the total sales and have already generated CHF 41.4 million, which is a huge boost as compared to sales (CHF 42 million) from an entire year in 2020. The credit for this extraordinary rebound goes to blockbuster auctions like Phillips’ Geneva Watch Auction XIII, Christie’s Rare Watches, Phillips’ HK Watch Auction XII and The Legends of Time by Christies, which set the ball rolling for what seems like a remarkable year for auctions.

Amongst the top auction houses, the new market leader, Christie’s sold nine watches with a price tag of more than one million CHF, followed by Phillips that sold five, Antiquorum, Poly Auction and Sotheby’s each sold one timepiece.

Web Auctions Takes Lead

Results for the top auction houses.

Christies Claims Pole Position

With a series of world records to its credit in spring 2021, Christie’s accelerated to the number one position in the market this year. The auction house almost doubled its sales from 2019 to touch a record CHF 84.5 million in the first half of 2021. The strategy for Christie’s seemed pretty straightforward as it made its events more inclusive with a wide range of “affordable” timepieces to lure in younger, first-time bidders from across the world. The auction house has organised 18 events so far, including 14 online auctions which offered watches at an average price of CHF 7,800 per lot.

The “Auction of the Decade” for Christie’s was “The Legends of Time” event in Hong Kong that witnessed an impressive average selling price of over CHF 930,000 for its 18 lots, including 13 Patek Philippe timepieces. The event attracted world record prices for 10 lots, eight of them Patek Philippe, along with a Rolex and an F.P. Journe.

With more volume (121 lots), “An Exceptional Season of Watches”, also organised by Christie’s, was the preliminary session to “The Legends of Time ”. “Together with “The Legends of Time”, both sessions, held during the afternoon and the evening of the same day, achieved total sales of CHF 31.2 million. This has been the best-ever result for a watch auction in Asia,” states the Hammertrack report.

The Unique Patek Philippe ‘Gradowski’ Grande Complication sold by Christie’s at the “The Legends of Time ” in May.

Up by 141 percent as compared to the first half of 2019, Antiquorum’s performance was mainly driven by two events held in Geneva and Hong Kong, which accounted for 63 percent of their sales. This helped the auction house boost its market share to 16 percent as compared to the full year of 2019 (8 percent) and 2020 (7 percent).

Sotheby’s, Bonhams and Poly Auction shared the remaining 20 percent market share.

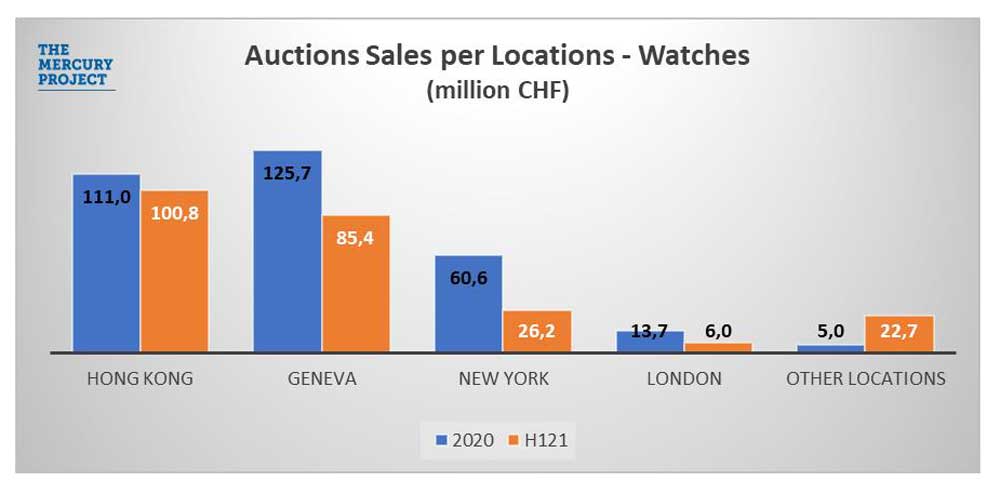

Hong Kong Overtakes Geneva

Hong Kong overtook Geneva reaching CHF 100.8 million in auctions in the first half of this year.

Winners All the Way

Patek Philippe continues to demonstrate its supremacy this year with an impressive presence in 16 out of the 18 millionaires watches. According to the Hammertrack report, the brand dominated the top four slots for the most expensive watches sold in the first half of this year’s auction season. On number five was the Rolex Cosmograph Daytona ref. 16516 sold by Sotheby’s for CHF 2.85 million in April, 2021.